The last SPAC IPO of the year closed on December 30th, with nearly 100% of the SPAC shares redeemed for cash. Moolec $MLEC shares are already down sharply at the start of trading Tuesday. There are warrants, but those are typically ignored in a situation like this. Redemptions were extremely high, so there are very few shares in the float until they release more. Retail investors are not as active as they were a year ago, but it's still worth watching for a squeeze. Our fundamental investment view is below.

The only reason this deal is making it out is the small "backstop" agreement that will give them enough cash to operate after paying deal expenses. The equity value at $10 is $376M. But cash on the balance sheet will be minimal, and the company is pre-revenue. Cash burn appears low. They rely on partners for most operational needs. Still, I'd expect the company to be eager to raise additional cash post-IPO.

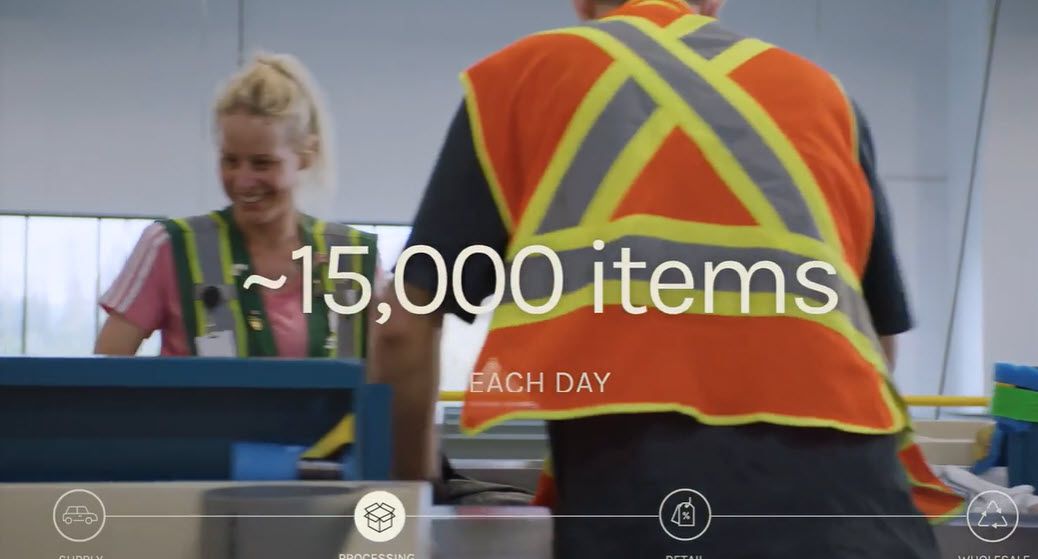

Moolec is a food ingredient company aiming at upgrading the quality of "alternative protein products" to provide better taste and nutrition. They lean heavily on a message of being science-based with loads of IP and engineering supporting their products.

This is a Bioceres $BIOX spinoff, and they remain involved as investors. Bioceres came public via their own SPAC IPO. It was announced in November 2019 and became effective in July 2019. The shares languished for two years at $5 before moving to the current $10-15 range. $BIOX shares held up well in 2022 compared to the market. The current $BIOX market cap is $755M.

Putting the Animal in the Plant

The "big story" for Moolec is that they aim to solve the sustainability problems around animal protein by engineering plants (especially soybeans) to produce the type of protein found in cows. Despite the failure of Beyond Meat $BYND as a stock, the industry has been shipping more and more plant-based protein products. They lack the taste and texture that most consumers expect from real meat, but they can work in some formats (ground meat) and food types (tacos).

Other non-animal approaches to more sustainable meat products include culturing or growing the tissue in the lab, fermenting plant-based proteins to modify them to be more "meat-like," and a few whacky attempts to "print" meat-like substances. None of these appear to scale up or be cost-effective so far.

One micro-cap company, BION Environmental $BNET, is doing something different by attacking the immense water needs and "emissions problem" with changes to how cattle are kept and raised for beef production. The core idea is to capture, renew and recycle more of what's used. BION has received some coverage in our LD Micro Trip Report, but until they complete their pilot, we're only tracking them.

Our view on the industry is that there will be multiple approaches to producing protein for human consumption that does not involve raising and slaughtering animals. That doesn't mean we won't still be eating as many chickens, pigs, and cattle as before, but the additional protein types will grow supply and serve use cases where taste and mouthfeel are not as important.