Capital markets are showing some semblance of "normal," with the few deals priced recently holding up and several new deals in marketing now.

For the first time in a while, the large banks are active with multiple deals - Goldman with Kodiak Gas Services $KGS, JP Morgan with Savers Value Village $SVV plus Fidelis Insurance $FIHL, and Citi with Vesta Real Estate $VTMX.

These deals are solid enough to get done in this tape, even if they are not precisely existing companies for the future.

Savers Value Village $SVV

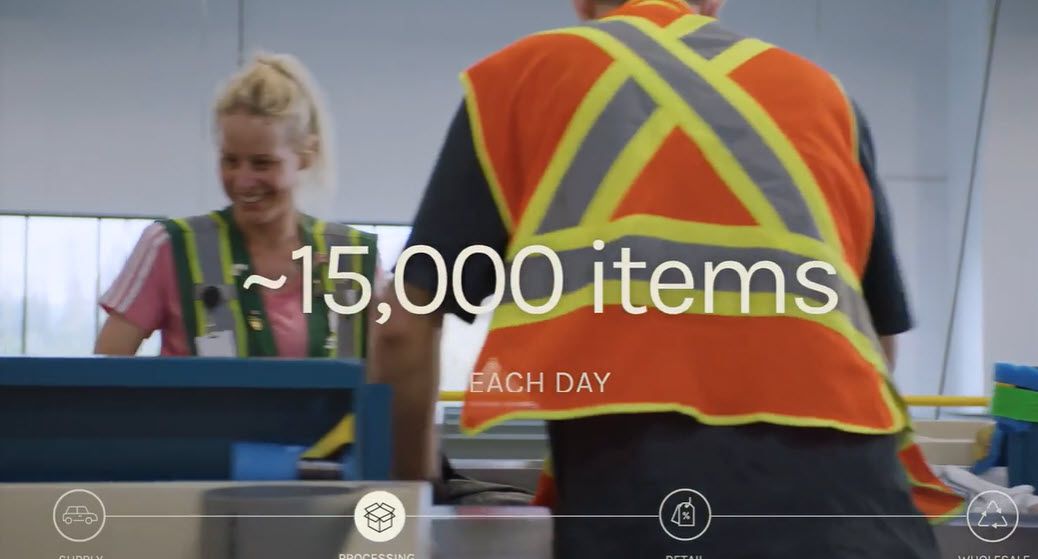

I've often wondered where some of the clothing donations dropped off at various locations ends up. It turns out that a lot gets sold for cash by the pound to companies like SVV that process it into items that can be merchandized and resold, or low quality that is bulk packaged and sent off for rags or recycling into base materials that can be reused in other applications.

SVV uses a network of thrift stores to resell these items to consumers for reuse at a fraction of the "new" price.

Management leans into the message of the "circular economy" and how they are an essential part of this new trend. I'm unsure how new this is since The Salvation Army and Goodwill have run large networks of thrift stores for decades. They may not be as robust as they once were, but they are still much more extensive than SVV.

The company claims that its technology helps set them apart since centralized operations and data science allow them to price merchandise for better sell-through. They do turn their inventory over reasonably rapidly.

Some investors may view SVV as a potential "stock for the lean times ahead" as they might a TheRealReal $REAL or ThredUP $TDUP but none of these companies has been proven to benefit from a down cycle.

At a $3.3B EV the P/E seems high at 35x. I'd be expecting to pay about 1/2 of that valuation.

Kodiak Gas Services $KGS

This is a steady, unspectacular grower servicing the US energy system with compression services, the bulk of it under contract and predictable - and fairly independent from energy prices.

Margins are high. In 2022, they had adjusted EBITDA of $400M on just over $700M of revenue. Even with steady CapEx, the company is a cash flow machine.

This kind of cash flow makes it easy to raise debt, and the company has piled $2.8B on the balance sheet. Pro-forma debt will drop to just over $1.8B.

Pricing here is also at a premium. The EV of $3.5B is 2x sales and over 21x earnings.

It's been a tough year for energy which may help Kodiak get into energy-focused portfolios because they are less dependent on price to maintain high margins.

Fidelis Insurance Holdings $FIHL

Of the three this one interests me the most. Fidelis serves more specific markets where a company can develop a competitive edge and achieve better pricing and margins.

Growth has been modest but operating returns on equity are high at 21% although the company is guiding them lower to a target range of 13-15%.

There's a complicated framework in place for underwriting support with the private Fidelis MGU.

This one at least makes the watch list. At an EV of $1.8B it's being offered at a ~15x P/E. Demand will be driven by institutions. If the shares dip post IPO then it might get attractive enough to buy.