Benessare Capital $BENE has announced that June 3rd is the record date for shareholders who want to vote on their proposed combination with eCombustible.

The deal has been controversial from the start. There was no investor deck released along with the announcement with only vague details offered in a press release about a "hydrogen-based fuel" that could be used in existing applications with "little to no modification" required. It sounded a lot like hand waving and hocus pocus.

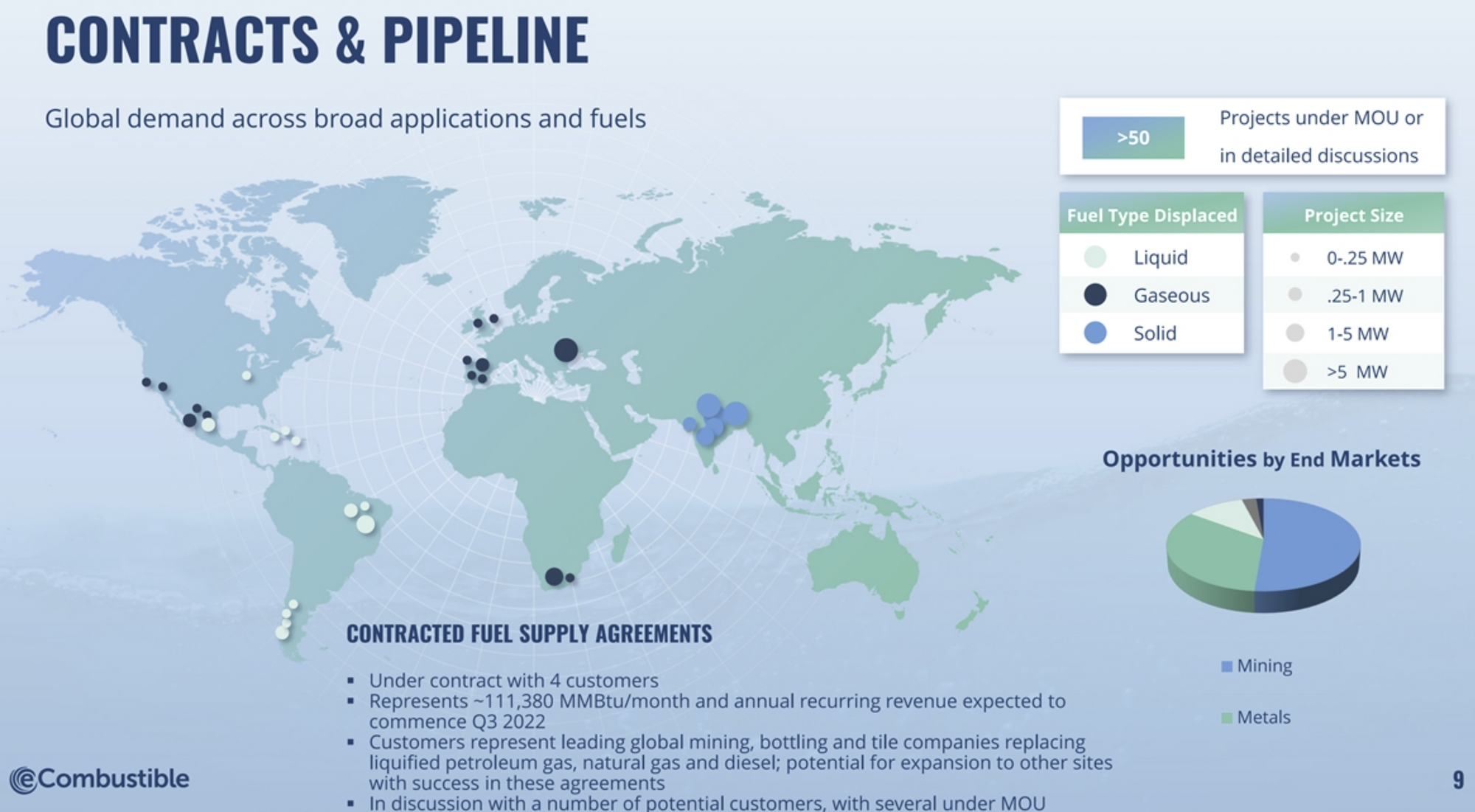

Since then the company did release an investor deck that provides a modicum of an investment case. The only material slide presented highlights contracts with 4 customers and 50 "projects under MOU or in detailed discussions." Recurring revenues from agreements are said to start in Q3 of 2022 although no financial projections are given.

More recently the company announced a deal that includes a long-term contract said to be worth $500M in revenue over 10 years from Pemesa Grupo Empresarial which makes ceramic tiles in Spain. They also are making an $11.2M investment in eCombustible.

Since margins are completely unknown the stock is uninvestable even if we do get some visibility on revenue and growth. Making matters worse, the primary comp offered is Plug Power $PLUG which grows but continues to have large negative gross margins! Some analysts have basically called Plug Power a near-fraud. The financial results are certainly dismal. They do somehow have a $9B valuation.

With ~95M shares outstanding the market cap would be $971M. I'd expect very close to 100% redemption on this one. As of last November, there was no minimum cash condition for the deal to go through.

It's worth noting that this sponsor is the same one behind Digital World Acquisitions $DWAC AKA the "Trump SPAC" that promises to become the Trump Media and Technology Group.

Given the market cap of $DWAC maybe they can buy up $ECEC at pennies on the dollar when it starts trading? I mean if it's such a great deal then they should fold it in.