After going through the investor deck three times it's not that easy to grok. If you are familiar with how company employees are treated in France you will get it faster.

[This is an international spinoff from Sodexo $SDXAY so if you only care about the US markets you might skip it.]

Corporate employees in France all go out to enjoy a full sit-down lunch. It's a full hot meal including a small appetizer, hot entrée of the menu, wine (of course), and a little dessert and coffee. This is because companies provide a voucher that they can use at the restaurant to pay for their meal. Not only does nobody turn down a free hot and very good meal but it's also a way to enjoy a full lunch hour.

Americans who view eating a sandwich at your desk while working and taking calls as the way to do "lunch" might find this hard to understand. But like it or not it's an established practice in many places.

It turns out France isn't even the leader here, Brazil is. (It could be that greater inflation there makes a defined benefit more valuable than in other markets.)

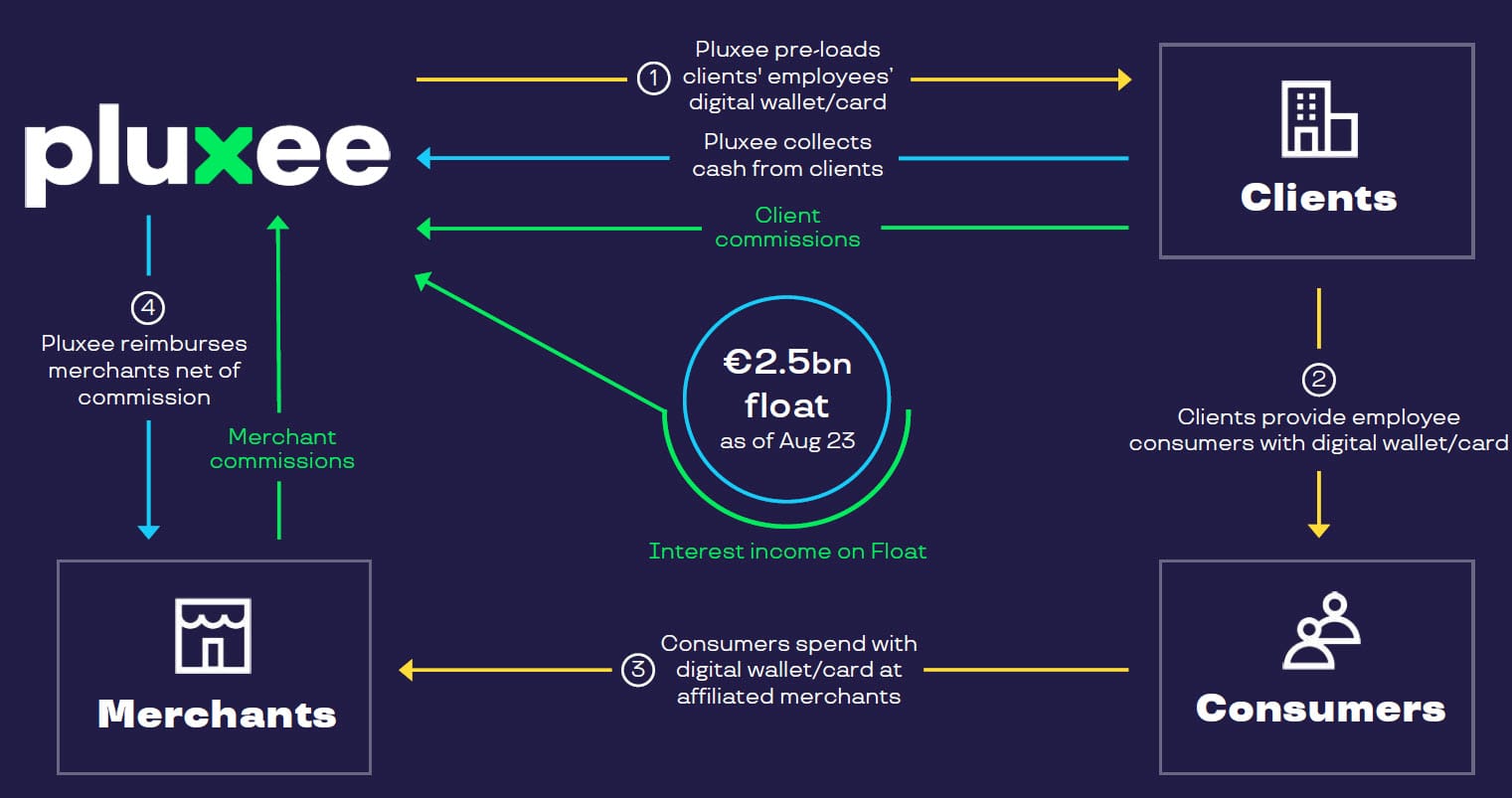

The simplest way to think about Pluxee is as a provider of meal/food benefits to employees via a digital wallet/voucher. In exchange for their service, they get a small commission from the employer and a small commission from the merchant.

This business works because it lowers the cost for employers while being valued more highly by employees in terms of purchasing power. The juice varies but jurisdiction, regulator framework, and economic values but it's almost always there.

This is a growth business and the margins are excellent. In addition, because Pluxee gets paid first they earn interest income on the money collected before consumers spend it on meals.

Work from home (WFH) means expanding into other channels. Pluxee has added online merchants like Uber, Deliveroo and Just Eat to enable at-home meal consumption during the workday.

Pluxee could be interesting if they could leverage their network into more categories, merchants, and consumers.

Consumer experience with the platform appears to be in the "shitty" category but they are improving and there's nowhere to go but up. This will help in getting into other categories.

Brazil

A big partner (Santander) can make a big difference. Penetration is huge in Brazil in no small part to this partnership. The value stems from the massive existing relationships.

By partnering with a large bank Pluxee has access to over 1.4M B2B clients, 750K merchants, and 6.5M consumers. (in this case)

If this approach can be replicated it could dramatically accelerate their growth in the core business.

Valuation & Stock Conclusion

Using round numbers here we have 1B in (largely recurring) revenues growing 15-20%, 35% EBITDA/cash flow margins, and a nice little 100M+ float interest income benefit.

Operating profits are 285M with net profits circa 200M (excluding what the company hopes is a one-time provision for litigation with the French Competition Authority.)

The shares are reading at a 4.5B valuation in their debut this week. The shares are trading at 29 Euros vs the 26 "reference price."

At over 20x current net income, it would seem fairly priced for now. However, they have a large fixed cost base that would allow them to grow operating earnings much faster than the top line in the next two years.

If we consider a top line of 1,200 for FY24 and 1,400 for FY25 we could see net profits of 300M and 400M respectively. On those numbers, the stock can double in two years to 60 Euros/share.

That makes it worth owning here and one that could get compelling on any pullbacks post-spin.