Roy Smith (ex-Goldman partner turned NYU professor) would always remind us that real-world corporate finance aims to find out where there is enough "juice" to squeeze, and global natural gas is now a compelling target.

Natural gas in the US is so plentiful that it's often just burned off. It's in short supply and expensive in other parts of the world. The challenge is that gas is not easily transported. There are two ways to profit from the situation: move the gas from cheap markets to expensive markets or move your energy-intensive operations (think AI data centers) to where the gas is.

Our IPO under examination, VentureGlobal $VG $40 - $46 (Goldman), is focused on the first one. Decades ago, we found ways to compress it into a liquid that could be shipped. It's taken that long to make it scalable and efficient.

UPDATE: After substantial pushback from institutions early this week, the company slashed its proposed range dramatically to $23-27. These deals can sometimes work well. Prices tonight to trade tomorrow.

It's still a complex, time-consuming, and capital-intensive proposition. That's the reason it's been slow to get implemented. The US and Canada have been aware of the opportunity but have hesitated to pull the trigger on many big projects. There is conviction now that the "spread" between the markets is durable and will drive increased investment in natural gas liquid (NGL/LNG) production and transportation.

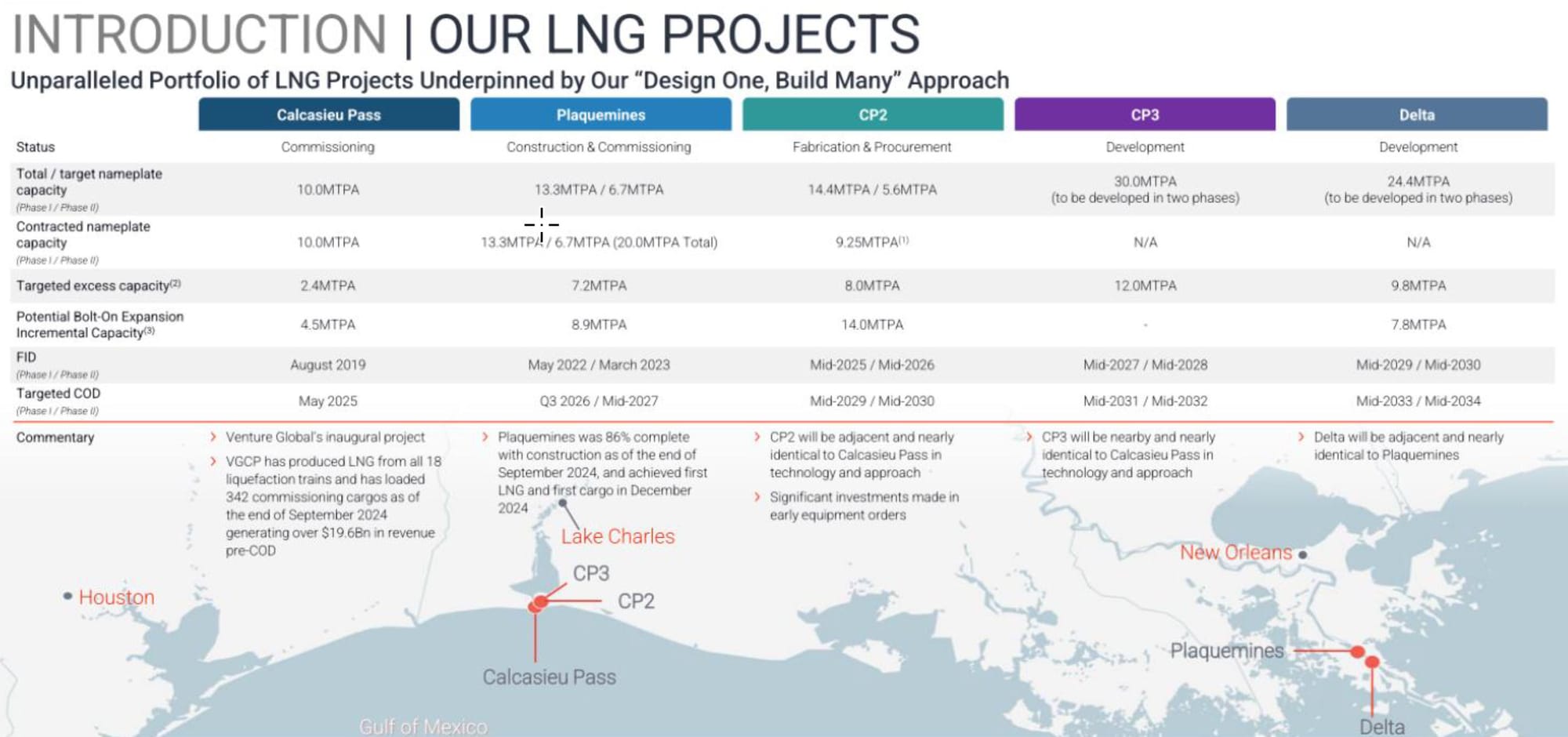

VG is taking a more innovative approach to project management, financing, and eventually running the business. The aim is to create a substantial global layer in NGL with a core of long-term off-take agreements but a reserve of "excess" capacity that can be used opportunistically to offer additional gas when prices are high.

VG has ambitious plans to multiply its footprint using the recently completed Calcasieu Pass as a template. The strategy includes the role of "excess capacity," which can be used opportunistically, and "b0lt-on" capacity for sustained increases in demand.

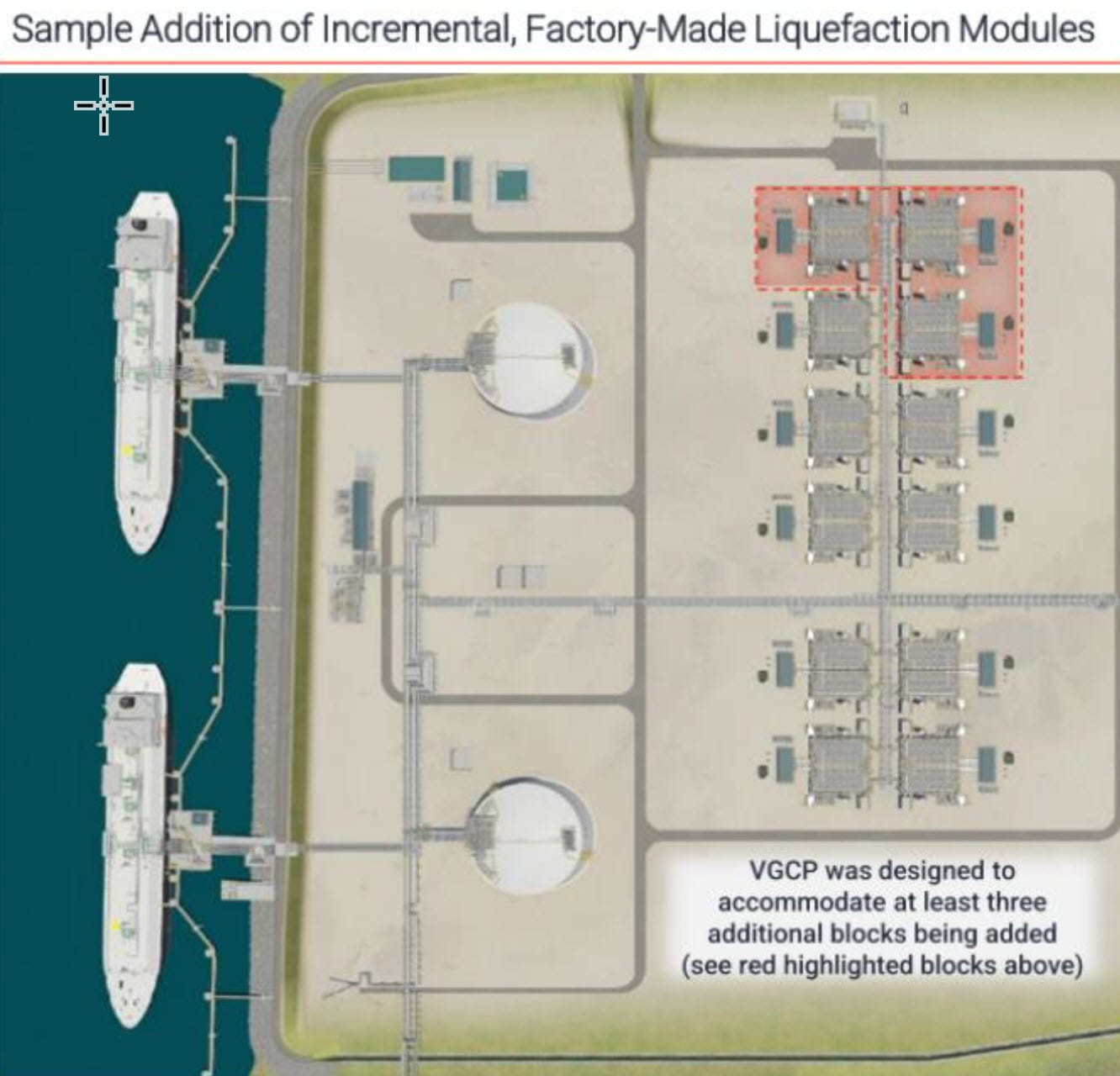

VG relies on suppliers like Baker Hughes $BKR to make the NGL manufacturing equipment and offer a "modular" approach to building an NGL facility. This enables them to build in phases and pre-sell capacity to help finance the construction.

The design allows a facility to get operational and scale up capacity over time.

Valuation, Sensitivity, and Stock Conclusion

VG immediately raised a valuation concern, which has been addressed with the lower range. This reduces some of the short-term risks on the table.

NatGas has burned investors and worries about the sustainability of current market conditions and spreads.

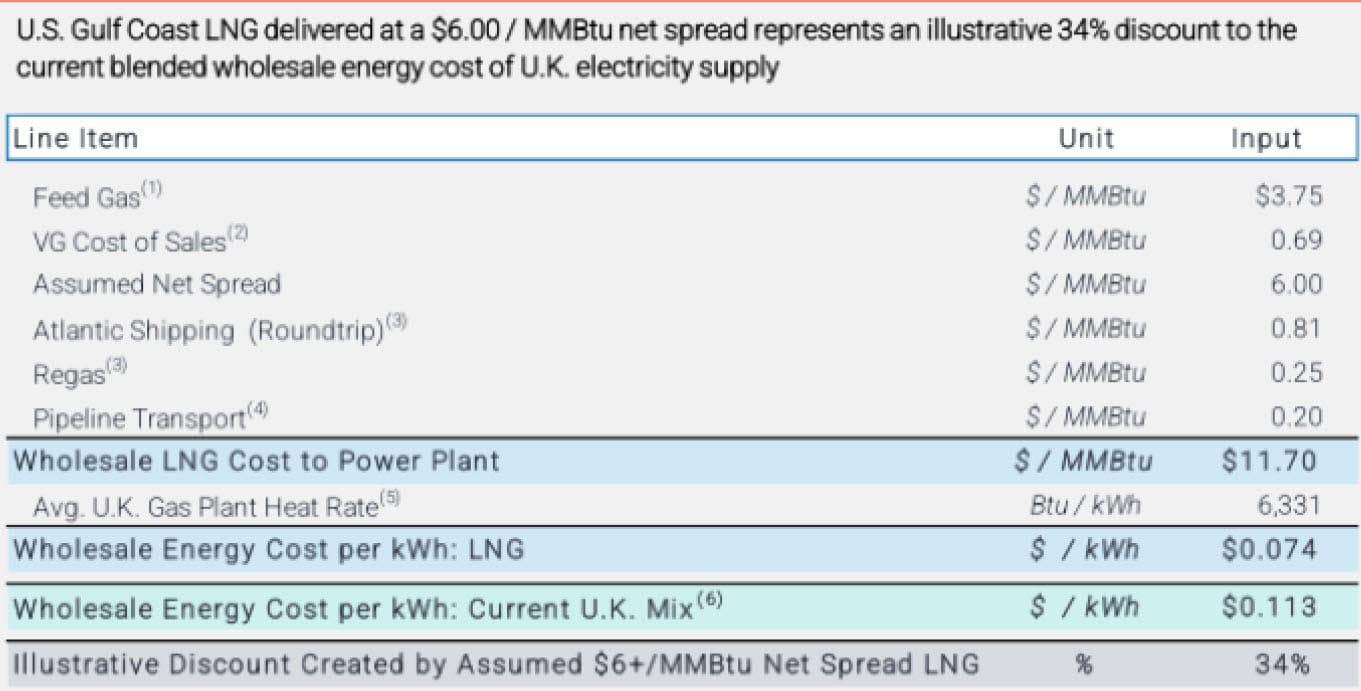

The economics are sensitive to input prices, transportation costs and the prevailing spread between the US and other developed markets such as the UK.

Using the company numbers below, things work out well for everyone - VG earns a good spread, and the UK can save up to 1/3 of electricity costs with imported LNG.

The trends favor VG, as US natural gas prices will likely remain stable with increased drilling incentives.

It's also not widely appreciated that higher oil prices tend to result in lower natural gas prices. This is due to increased drilling for oil that generates "unwanted" natural gas as a by-product.

It all suggests being long VG out of the box within the new reduced range.