StandardAero $SARO priced their upsized IPO above the range at $24 last night and is indicating a solid open ($26 as we write this.)

The deal follows the surprising success of Loar Holdings $LOAR which priced well earlier this year and has doubled since then to trade at 18x sales and 70x 2026 earnings.

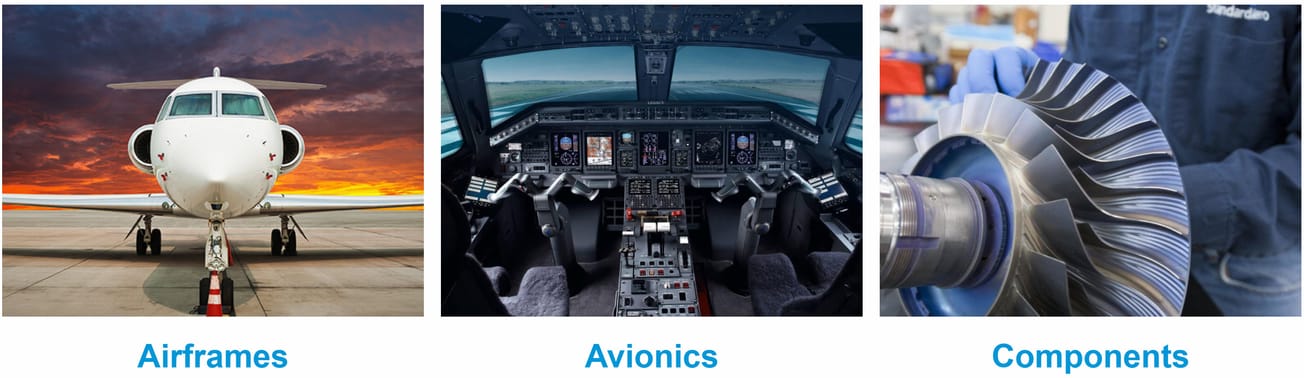

Aerospace and defense components are among the many industrial areas now targeted by institutions.

This is a different business with lower margins, so it is not likely to achieve the same lofty multiples. At $24, the market cap is $8B, with an EV of $10B on sales just short of $5B. The company is near break-even.

Using the back of the envelope, I think the shares have at least 50% upside from these levels, depending on whether one uses P/E or EV/EBITDA ratios. My best guess is that if it opens in the mid-20s, the shares will work their way into the low 30s when the quiet period ends.

Current markets are giving premium multiples to companies with stable businesses and penalizing those with more lumpy and uncertain near-term outlooks. $SARO is one of the good ones.

Other Deals

FrontView REIT $FVR priced in the range at $19 to raise $250M with a $520M cap and $700M EV.

Two smaller but not bad deals are scheduled for this week, too: Synergy $SNYR is a provider of health supplements entering the RTD energy beverage segment (think Celsius $CELH), and BingEx $FLX, which is (you guessed it a "Chinese FedEx.")

By the way, we can't justify adding Celsius to our Broken Candy portfolio, but the shares are at a 52-week low due to the Pepsi inventory situation. The growth is real, and this is a strategic asset, so one should be interested down here at $32.

Finally, next week is shaping up well, with KinderCare $KLC and Moove $MOOV planning to raise $600M and $400M, respectively.

With US markets nearing an all-time high, we expect the IPO markets to begin to "catch up" now. We will share more on the "IPO Elephant" in a post this weekend.