Yesterday PLBY Group $PLBY presented at the ICR conference and it's been a while since we posted an update. Playboy went into our SPACvest Model Portfolio and our personal account when their SPAC combination was announced back in October 2020.

Although the company had shuttered the magazine and sold the mansion they still had considerable brand equity, particularly outside the US, and profitable licensing arrangements. Many of these were legacy deals that are ripe for renewals at better terms after years of neglect.

The deal was done before SPAC terms got inflated so the valuation was very reasonable. With an EV of ~$400M it was being valued at about 1x their book of contracted minimum royalties. It didn't take much analysis or math to quickly conclude that the shares would at least double from the $10 SPAC price.

The shares stayed quiet for months around our entry price of $12. Then the shares got swept up in the general SPAC mania in the spring of 2021 - vaulting to $60/share.

Although it was largely sold out of the RMP on the rise some shares remain and we're keeping it in the Model Portfolio for now.

In June of 2021, we did post an update after Playboy announced they were acquiring luxury lingerie brand Honey Birdette for ~$330M in cash and stock.

At the time we noted that it added some complexity and confusion to a story that wasn't that clear to start. Management talked about a brand dedicated to "sexual wellness" but it was difficult to picture exactly what that business would look like.

The positioning of the company as an e-commerce platform started to make some sense. That would require integration of disparate parts of the company and some rationalization of brands that would take time. In addition to Honey Birdette, they have brands like Yandy.com and Lovers.

Fortunately for the company, their brand is strong in certain geographies outside the US and it remains a viable "street brand" outside of the "sexy" clothing category.

Their online businesses should be able to support their growth plans in the medium term but they will need a more unified front in 2023 and beyond.

NFT Gold Digging?

When the NFT movement got going it was hard not to imagine that a company like Playboy would be a good fit. They have a trove of original content that goes back decades and would appeal to a broad audience including younger crypto enthusiasts and older consumers who might feel some nostalgia.

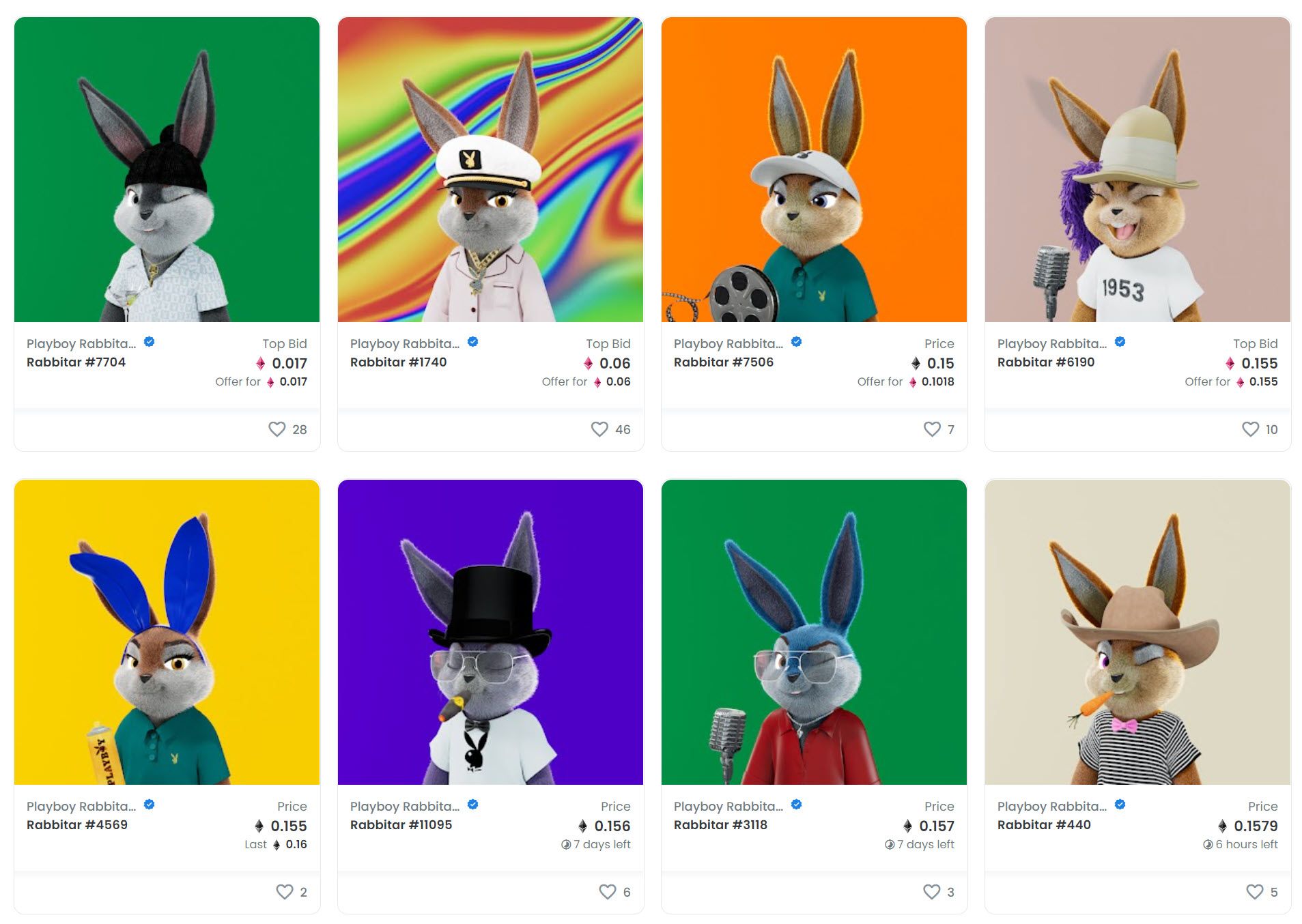

Their initial foray was something called "Rabbitars" that I would describe as a misguided effort to throw something against the wall to get investors excited. It worked in the short term as seen in the stock chart above. You can learn more about it at PlayboyRabbitars.com.

There was some notion that ownership of a Rabbitar (it makes me a little sad to have to type it again) would confer some special "membership-only" perks which for the moment seem to involve attending some future virtual party in the metaverse.

They also created a lot of them (11,953) in an arbitrary fashion which is customary for many made-up NFT creations. But that's what people do when they don't have valuable original content and potential experience offerings to bundle. Playboy could have done much better.

The proof is in the pudding over on Opensea where the critters are essentially all on offer and going pretty much "no-bid" right now.

It's billed as a learning exercise now and they are planning on building some kind of platform to move further into the NFT space with their own ability to create, sell and transact.

I think there is real potential in the space but it's largely obscured by all these random offerings being done to grab money and attention in the short term.

Another "Creator" Platform

PLBY launched their new "Centerfold" platform which is designed for "creators" to connect and do business with their followers. It doesn't appear to be very built out yet but none other than Cardi B has been appointed the Creative Director in Residence.

It's kind of a soft-core version of the original OnlyFans which was pornographic enough that Visa and Mastercard threatened to stop accepting payments for the site. OnlyFans pivoted to avoid sexually explicit content to stay in business. Now it's more like a site where you can engage in more playful but still scantily clad entertainment.

The Playboy Centerfold site is mostly galleries of photos posted by approved creators for now. They pretty much all look exactly like the models you would expect to see in a Playboy magazine. There's not a lot of diversity of expression here yet.

Some content is freely viewable but more revealing photos require a subscription. Followers and subscribers can interact with creators via chat. The company plans to streamline the process to get more content on the site but it's not clear what types will be supported.

The tagline is "a platform for creative freedom, artistic expression, & sex positivity." Nothing to argue about there but it does beg the question around what modes will be offered.

Besides OnlyFans there are some other companies out there playing with the "blue platform" idea and its kind of tricky. There are lines around content, engagement, privacy, and safety that all have to be minded at the same time.

As for a business model, the Centerfold platform keeps a 20% cut of the creator revenues but does offer them an opportunity to generate additional revenue if they refer other creators that have success on the platform. That's the same deal OnlyFans has.

OnlyFans has 39M visitors per month and 17-minute average visit duration. Centerfold is still nascent with about 100K visitors and a 5-minute average visit.

Stock Conclusion

Despite working hard for over a year it still feels like the company has a lot to do in order to get things humming. Their core business is steady and at these prices is probably fairly if not fully valued.

The growth initiatives are a little wobbly to bake into any expectations for this year and unless they improve in the next six months that will still be the case for 2023.

This year analysts expect them to generate $50M of EBITDA on $340M of revenue. At the current stock price that's about 3x sales and 20x EBITDA.

I'm going to keep what's leftover from the original investment in the RMP for now but regard it as a "close watch" name this year to see how things play out.