Penguin Solutions $PENG spent the last three months preparing for its big makeover day. Yesterday, they botched it up, some with a squishy quarter and some hand waving on guidance.

As a reminder, the company held a full analyst day in July to prepare for the rebrand and elevate the company into a more focused provider of AI data center integration services.

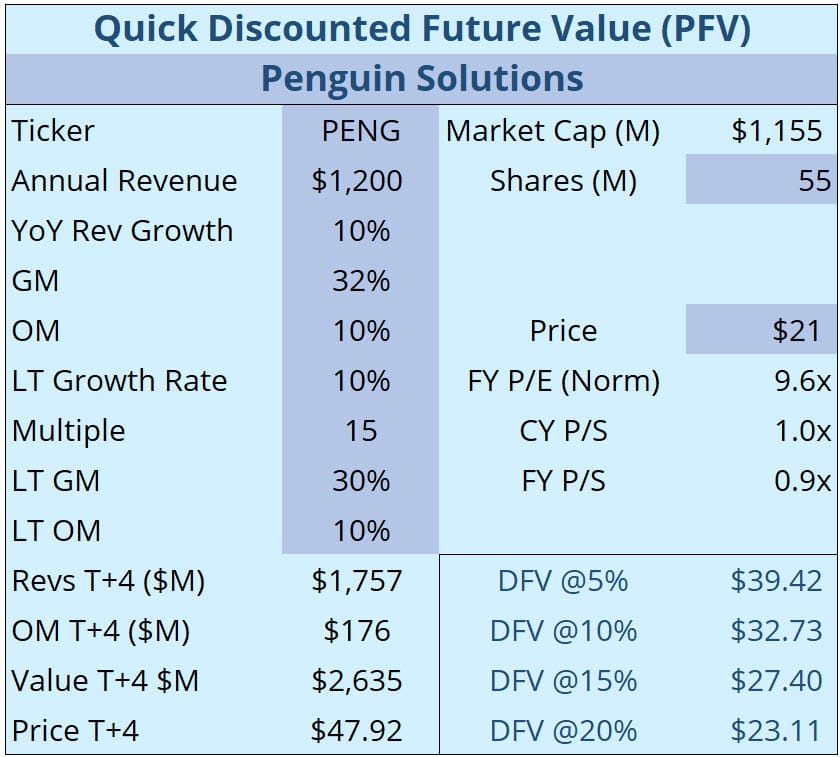

I was looking forward to having a new name in AI infrastructure with scale, profitability, and a very good "growth at the right price" valuation. (Even though management did a lousy job with the relaunch timing, the fundamentals have not changed from yesterday, and the shares are now 25% cheaper.) You can review our "Penguin Solutions—Part I," which outlines a bullish case for the stock.

Don't Forget to Sandbag

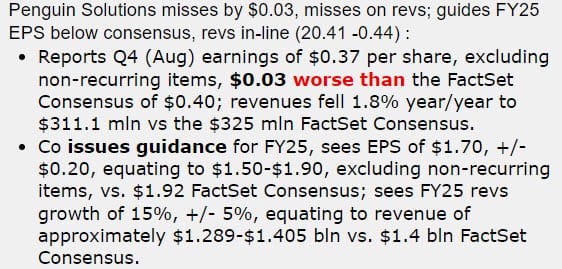

Shares were down sharply on the rebranding debut because management didn't deal with guidance for their FY Q4 reported yesterday. They also didn't set expectations low enough for the current year, FY 2025.

Nobody can predict the future, but you can set low expectations that even dismal results will be celebrated. We see this daily as companies report declining growth and shrinking margins that result in "beat and raise!" quarters.

If you spend much time and money on a rebrand, please consider all this. The other obvious but often unspoken part is that this allows existing management to acquire more shares at attractive prices and signals to investors that they are excited about this new direction and committed to improving shareholder returns.

Perhaps worse of all is the small size of the miss.

For a few pennies and a couple of dimes, we see over $200M of market cap wiped out in a day and close to $1B since the peak of the rebranding effort.

What now?

The sell-off today reflected quite a bit of damage. Shares are now lower than before the rebranding effort started in July! Management has lowered investor confidence and reminded everyone that their business is still made up of some hard-to-forecast, low-margin businesses.

If it's running well, this is a 15x P/E business. I still think that's true, but now it's going to take longer to earn—analysts who cover the stock base their price targets on 12x.

Management should be buying stock personally at these levels. They should also get the LED business sold and make sure the bar on the memory business is very low since they won't get much credit for it anyway.

The IPS business needs to be the star, and growth there has to improve and be more visible. This is a time to win business and announce new contracts. Our checks indicate strong growth in this segment and see several companies, including big ones like Dell $DELL, rapidly growing their enterprise AI business.

Lowering my base case estimate for the shares after the recent update is prudent. Again, not much has changed fundamentally, but I'm shaving a little from long-term growth and margins. The 15x multiple remains because at these levels the company should be able to provide investors with the confidence that they can meet or exceed expectations. It will be much easier if they unload the LED business. It's a low-growth, no-profit business that lowers the valuation of the entire company.

If I'm correct, the shares are a double off this even more depressed base. We will get more aggressive if we see insiders buying and a greater sense of urgency from management.