Today, Smart Global Holdings $SGH has a new public company named Penguin Solutions $PENG. The move results from the company's decision to refocus on AI and move away from commodity memory and "diversification."

This is a big step forward, but more must be done to streamline the business and get all the wood behind the arrow of AI data center infrastructure services. The pieces are there, and the market opportunity is present.

With over $1B in revenues, positive operating margins and a strong balance sheet PENG has the resources to execute effectively. SK Telecom recently made a $200M "strategic" investment in the company, which could be more of a distraction than a benefit, but it's not material now—some thoughts on that after our conclusion.

Some History

The company was started in 1988 and became a significant memory system supplier in Brazil. It was acquired by Silver Lake in 2011 and reemerged as a public company in 2017, offering memory (DRAM & Flash) modules, specialty products, and embedded memory components. The business was still focused on Brazil with a smattering of specialty memory products that served diverse markets.

The business was decent then, with annual revenues of over $600M and EBITDA margins of ~11%. Still, this niche memory-based business didn't make the threshold of interest for us to cover, so we mostly ignored the IPO.

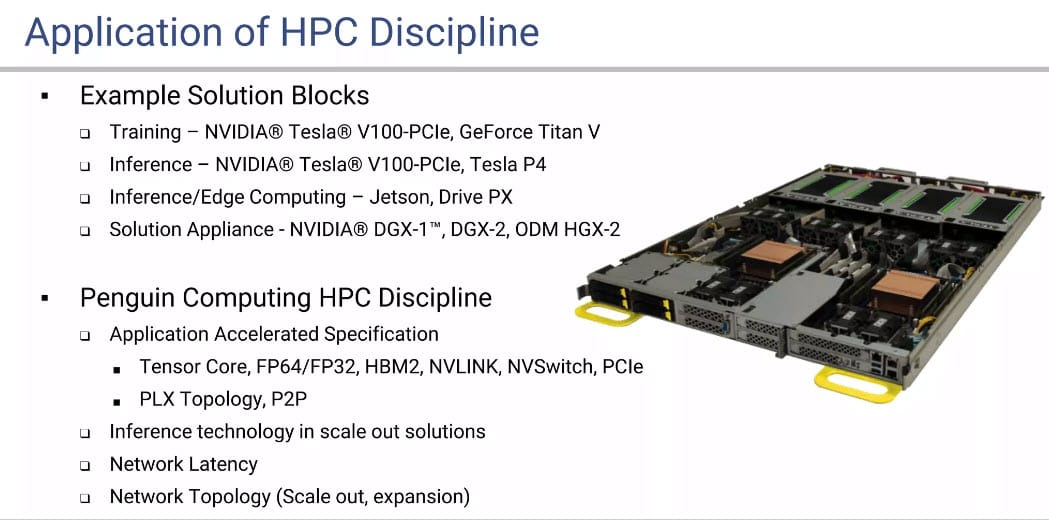

In June 2018, SGH bought Penguin Computing for $85M. At the time, high-performance computing (HPC) and supercomputers were regarded as an academic niche market for largely one-off solutions.

Penguin had already been around a long time, and these two slides, taken circa 2018, demonstrate their leadership and early focus on training and inference with Nvidia. However, they also integrated processors and components from other vendors, including Intel and AMD.

SGH continued its "diversification" (or perhaps diworsification) mission by acquiring two more companies.

The company purchased Cree's LED business in October 2020 in a deal that included $175M of cash and notes plus a potential earn-out of $125M. The LED industry has a solid 30-year history of being lousy, so why anyone would buy into it is a mystery. It's irrelevant to the story here and is unlikely to be in the future. Hopefully, the new "Penguin" will bite the bullet and sell it off.

If the company shut down the LED business, operating margins would expand to 14%!

In June 2022, they acquired Stratus Technologies, a venerable provider of fault-tolerant computing. I competed against Stratus back in 1988 when I was at IBM. Stratus systems were in demand at the time for driving things like ATMs that had to operate uninterrupted for lengthy periods. Stratus was the first to show off a revolutionary gimmick of "hot swappable" boards that could be added and removed while the system ran.

SGH acquired Status for consideration of $225M in cash with a $50M potential earn-out payment. At the time of the acquisition, the deal was stated to be "adding more than $80M of higher margin recurring revenue" to the company. That puts the purchase valuation at ~3.4x sales.

Stratus could be relevant to the future of the data center business in that high-availability inference ability may be an area companies will continue to invest in. Customer relationships are valuable. Revenue growth is limited, but profit margins are attractive.

The Now

The company hosted an analyst day in July this year to preview the new strategy and company. For FY 2024, the company still expects revenues of $1.2B with 32% gross margins and 10.4% operating margins (non-GAAP).

The Q4 and full-year reports will be released today after the close. In addition to recapping much of what they discussed in July, they will likely provide more specifics about what investors can expect in FY 2025.

Investors were not impressed with the long-term guidance of "high single-digit to low double-digit" growth given "the enormity of the opportunity." This is true for the data center services business but less so for the traditional hardware business, which is declining YoY.

There are still three lines of business: the good (Intelligent Platform Services or IPS), the bad (memory) and the ugly (LED). The mix is currently 50% IPS, 30% memory and 20% LED.

Operating margins on the three are ~20% IPS, 5-7% memory, and 0% LED. As noted above, shuttering the LED business would be immediately accretive to the company and shareholders. It would also put a bad past mistake behind them so it can not be spoken of again.

Memory remains an open question. As architectures evolve, so does the role of each type of memory in the storage "pyramid" that runs from an on-chip cache to a tape drive running inside an old warehouse.

How things are stored has direct implications for how things can or will be easily processed. There are new initiatives in memory and storage to adapt them to the needs of AI-intensive applications. Penguin has some content in this area and has been doing work in CXL which is an active standard developing in memory systems. Perhaps Penguin can migrate away from pure storage and cede that ground to Micron and Samsung while they focus more on the "glue" that companies like Astera Labs $ALAB is getting known for.

Before we get to numbers, the context here is that Penguin has a real business but with some "hair" on it.