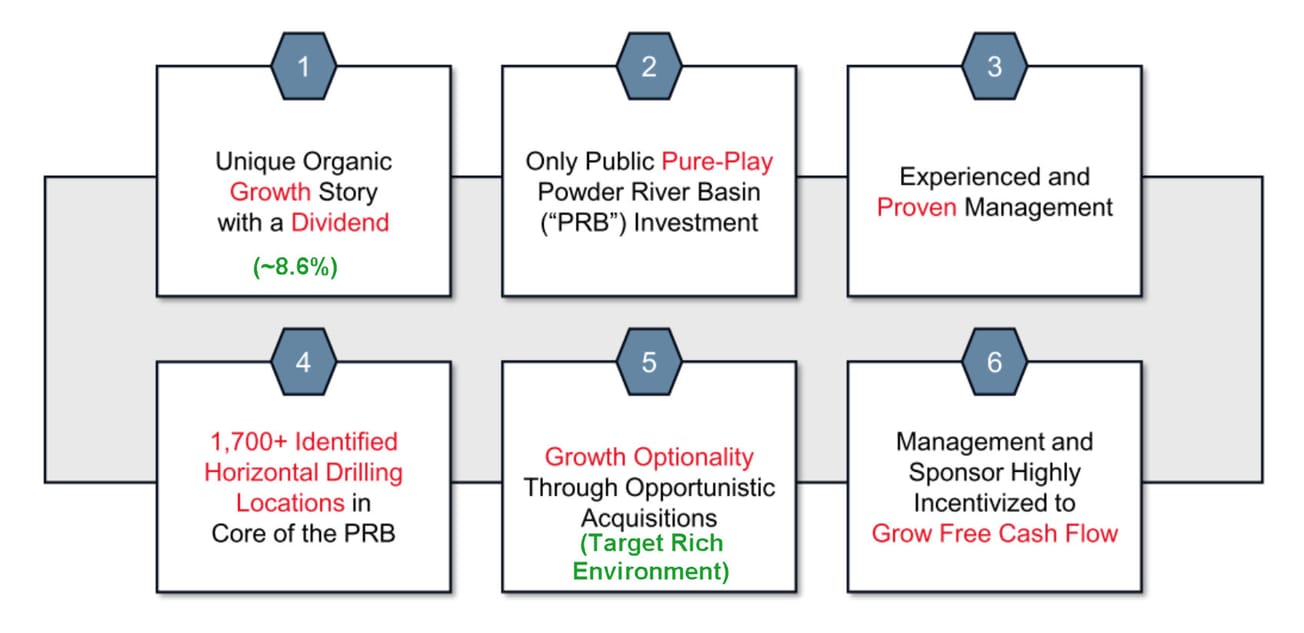

Peak Resources $PRB is a small operator producing oil and natural gas in the Powder River Basin in Wyoming. This low-risk, developing area offers good, predictable results for operators.

The basic story here is uncomplicated: they are drilling and selling off oil and natural gas in the basin. They also have a small (16%) ownership interest in PetroSantander, for which they receive current dividends.

The company will pay shareholder dividends as a "C-Corp," so investors will not have to deal with K-1 statements, which is a plus.

Production has been flattish at $50M in revenue but the company plans to use proceeds to expand production and projects a near doubling by 2025.

The 8.6% dividend at the midpoint is a strong draw for retail investors looking for yield and exposure to conventional energy assets. Renewables are growing, and there's renewed excitement around nuclear power, but these all tend to increase energy consumption. (The world is still expanding coal usage.)

The Possible Kicker

There's a longer-term play for Peak as a small put public fish in this PRB pond. If they grow and also acquire some smaller operators, they will reach a scale that would be more attractive to the large operators - Devon $DVN, Oxy $OXY and EOG Resources $EOG are orders of magnitude larger that want to keep growing in the region.

This is an established method for larger companies to grow. They need bigger targets, though, to justify the transaction. In Peak's case, they will increase production substantially in the next 12 months and could add much more through acquisition. In two years, they could have 4-5x of current production producing or in-process, supporting a sale to one of the big players.

The three large players in the PRB have a combined EV of $175B, compared to a pro-forma market value for the PRB of just over $200M.

Stock Conclusion

I have a generally positive view of US energy and materials production companies, so this somewhat colors my views.

If the deal prices in the range and trades quietly, I'd say it offers good risk/reward—especially for tax-free accounts that can bank the entire dividend.

Investors must rate the indicated yield relative to others in the same sector. For example, Devon, EOG, and Diamondback yield from 4% to 6% with more safety. We own a couple of others that are much more risky but may yield 20% to 30%, depending on natural gas price levels (versus expanding production in the case of PRB).