I stumbled on Atlis Motors $AMV while sifting through SEC filings. Given the abysmal IPO calendar, I had some extra time to look closely.

It's an interesting case study about taking a concept through to an IPO (even before turning it into a real business.)

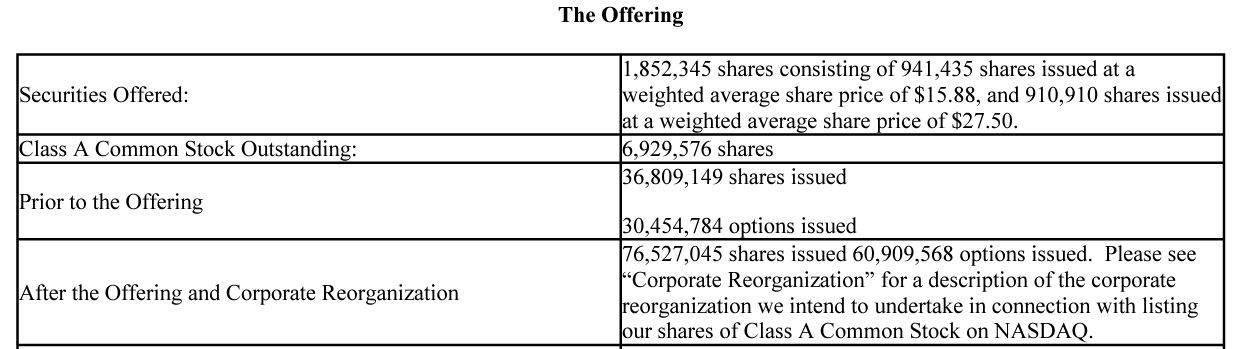

The punch line is that this company raised $7M through three Crowdfunded offerings and another ~$25M via Reg A+. They are now listed, and after some initial craziness, the shares have settled at the $18 - $20 range, giving the company a market value of something like $1B. (The share count is a bit fuzzy.)

According to a press release that I have not been able to verify, the IPO gives the company access to a $300M line of credit from an alternative asset fund.

The Crowdfunding Journey

Kickstarter got the ball rolling by funding the creation of new products in exchange for getting one of them when they are completed. I've done a few of these personally with mixed results.

Newer platforms like StartEngine allow companies to raise equity and offer subscribers products and perks. Altis used this platform to raise their first $1M in 2018. The presentation is good and successfully generates a "what the hell, let's throw a few dollars into the pot" response. It's like a lottery ticket.

They later raised another $1M at an $89M valuation on the same platform. A third CF round brought in $5M from over 4,000 investors at a $385M valuation.

As they got bigger, they did the offering via a firm called Rialto Markets, which specializes in firms heading through Reg A financing.

You can see all the offering pages via the company investing page.

What is special and unique about how they accomplished this is that they appealed to individual investors with the old "sleeves of my vest" strategy. In this case, offering early investors financial incentives tied to their investment. These included major discounts on future product purchases and "bonus shares" of stock.

This could be a very effective and efficient path for early-stage consumer product companies to fund their product, raise equity capital, and eventually become a public company.

Do investors understand a Reg A filing?

Maybe the better question is, do they read them? Many institutions probably don't either, at least not carefully.

So far, early investors have done very well with the stock trading much higher than what individuals have paid for their stock.

Since this is still a "story stock," investors are not focused on financials and valuation, but that will eventually come into play.

For the three months ending June 30th, 2022, the company had no revenue and posted a loss of $17M.

Getting the valuation nailed down is harder than it should be. TradingView has it as $865M, YCharts has it as $195M, and Yahoo Finance puts at just $95M.

The latest filing puts the share count at 36M, which is close to being correct and what's used at TradingView.

The IPO is accompanied by a "Corporate Reorganization" that includes the following paragraph (emphasis mine.)

The Corporate Reorganization will result in the (i) renaming of the Company to ATLIS, Inc., and (ii) each share of Class A common stock of the Company being exchanged for two shares of Class A common stock of ATLIS, Inc. and (iii) each share of Class D Common Stock of the Company being exchanged for two shares of Class B common stock of ATLIS, Inc. This common stock exchange is expected to increase the number of shares outstanding, however, the total value of the offering amount is expected to remain under the $75 million threshold for Regulation A+.

This step gets the valuation to $1.9B, as shown on the company website.

The Punchline

Professionals say "the IPO market is closed," but it's not.

- There has been a stream of regular way IPO deals this year that don't appear in the statistics because they have been below $50M.

- The SPAC IPO market continues to grind away, with nine new ones completing the IPO process in September.

- This scrappy process of CrowdFunding and Reg A+ is a path less traveled but one that can be very effective in raising low-cost capital from consumers/investors.