Klarna Erbjudande

Sweden-based Klarna $KLAR has filed for IPO and will be very much compared to US-based Affirm $AFRM, which has been public since early 2021. Klarna is the more innovative of the two, with bigger, more global ambition. Klarna is also a bank (this cuts both ways) and adding advertising to their business model.

Klarna got a lot of attention in 2024 when they announced that they were dropping Salesforce and Workday and using AI to build more of their systems internally. It wasn't hype - they have reduced sales and marketing expenses from $531M in 2022 to $328M in 2024 while accelerating revenue growth and reaching profitability faster than Affirm.

If it's really AI-driven it will be one big ROI proof point for investing in AI development (and possibly some terrible news for Salesforce $CRM.)

Pricing isn't set, but it's been said they plan to price at a significant discount to the last round of funding, and probably under Affirm. (Whispers are around $17B vs the last round at $46B and a 20% discount to AFRM.)

Affirm at $50 sports a $16B cap and a $22B EV on CY expected revenues of $3.2B. Klarna will be at nearly the same level of revenue as Affirm but profitable.

From a macro standpoint, the consumer discretionary category (and related) are not where the cool kids are investing now. There are concerns about slowing US growth and a possible recession as early as Q2. Lower consumer spending and more credit losses are the most likely near-term scenario.

Sentiment can turn on a dime though and lower rates and reduced inflation can turn things around in 2H 2025. One "quasi-macro factor" in favor of finance is the quashing of the CPFB and what are likely to be more lax regulation and enforcement over the next few years.

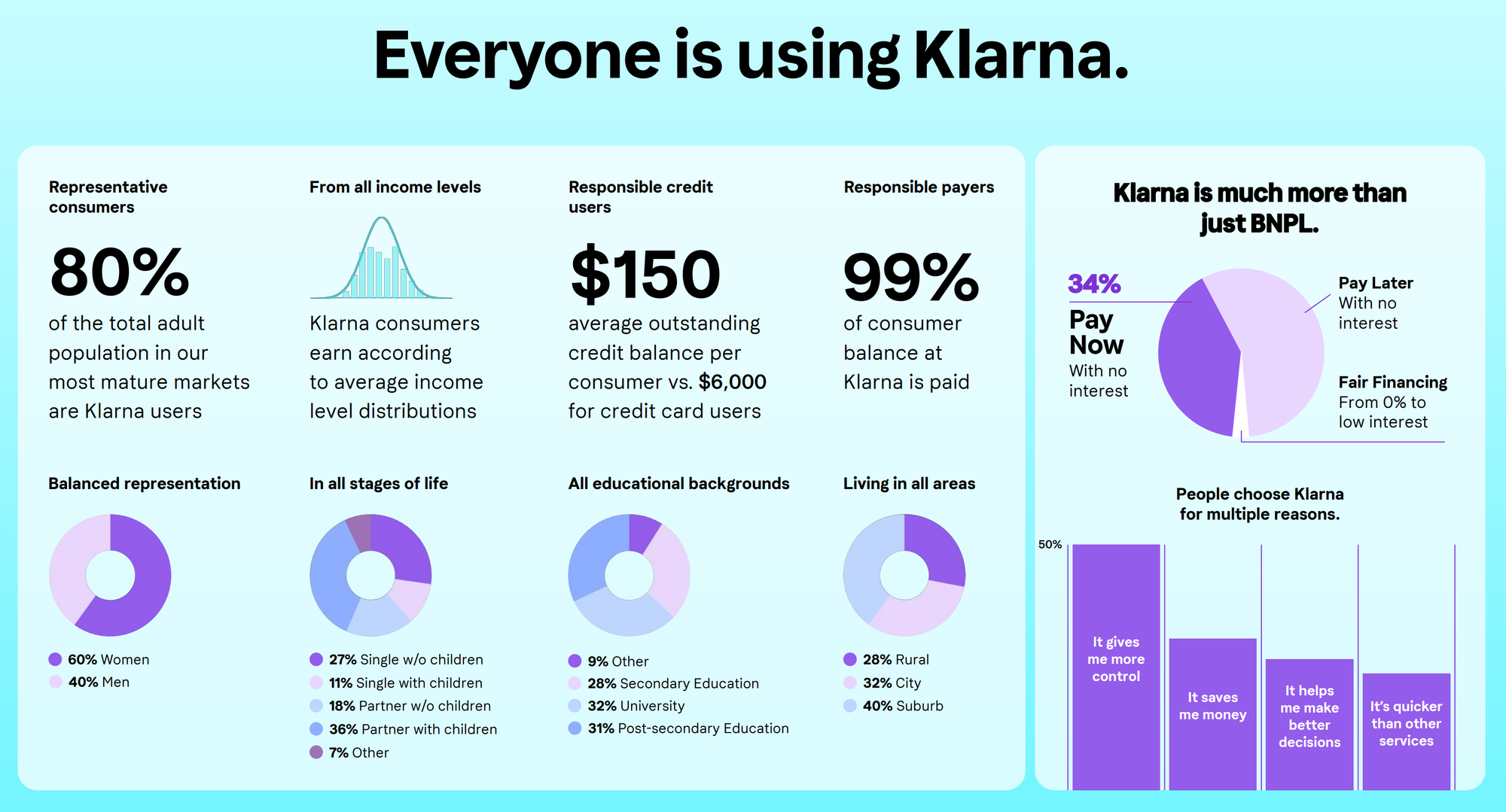

Positioning in BNPL

If you're still wondering "why is BNBL still even here?" the reason is that credit cards don't work for some things and banks don't make loans anymore. The main feature of BNPL is that it can be done on a single purchase at the POS and if payments are made on time with very attractive terms.

BNPL has been around a long time for large purchases. When I buy a tractor, Kubota offers something similar with "zero percent financing," which means I pay the entire price over 3 years with no interest. It's a no-brainer unless a discount is offered for cash, which is typically not done.

What's new about BNPL is that they can do it on any product, at almost any amount, at the POS and instantly. Even a $100 purchase can be paid in a few installments instead of all at once.

Credit card companies charge famously high rates of interest that can "bury" a consumer under a load of debt that they will never be able to pay off in exchange for making them send in $25 a month to keep the loan "current."

Credit cards only make good financial sense if you pay the entire statement balance every month. They charge over 20% interest, how does anyone agree to that? (I'll add a link to a great aside here later.)

Getting back to Klarna... they focus on the merchant side of the business like credit card companies did decades ago. Back then, "consumers don't have the cash in their wallet to buy your product, but if you take credit cards, they can buy it, we'll pay you now, and take a small fee." Today, consumers don't have cash or credit to buy your product, but we can make it happen in exchange for a small fee.

Klarna comes at it from the merchant side. They speed checkout, nudge average order value higher and improve the conversion rate. It's a clear ROI for the merchant. Klarna takes on the credit risk which is one of the core challenges of this kind of business - the "pay later" part of the deal.

Here are two perspectives of the checkout platform - the first from a merchant's POV and the second from the consumer.

As you can see there's more of an e-commerce slant to the Klarna story than the more payments-focused Affirm.