A few weeks ago, at a presentation, Thomas Laffont of Coatue and Chamath Palihapitiya did the rare and honest job of bringing some of our structural problems in capital markets into stark relief.

We relish the opportunity to understand the challenges facing new issues and equity capital markets and consider what outlets may emerge.

There are no easy answers, but we'll explore potential shifts in the IPO and new-issue capital markets that may offer relief.

Our IPO calendar has ebbed and flowed since 2009, but in many periods, we had 20 or more deals in marketing during many weeks. With the US markets hitting impressive all-time highs, where are all the IPOs?

The Money Chart

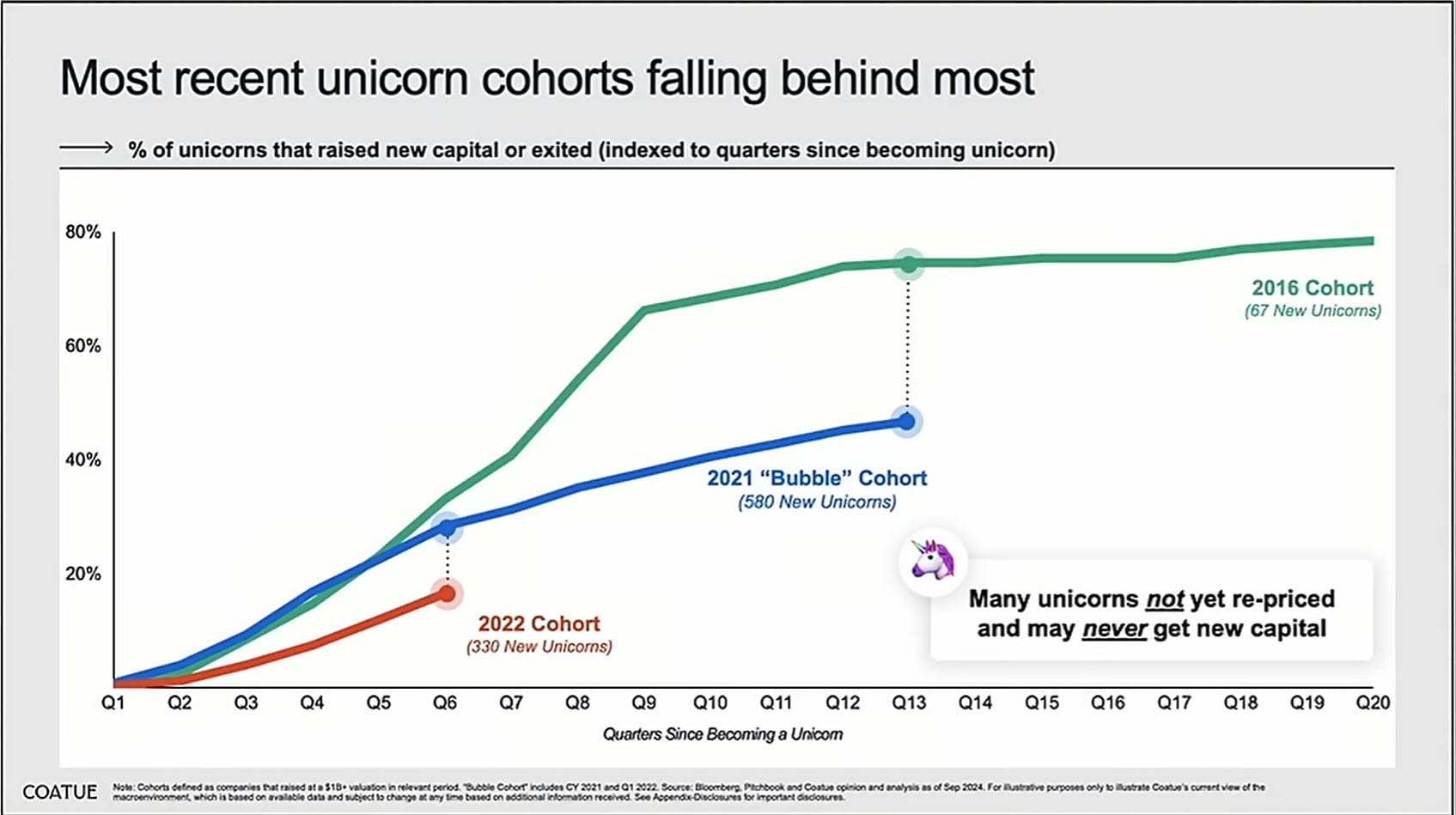

The entire deck is referenced at the end, but this is the trillion-dollar slide. It shows the growth of private companies valued at over $1B.

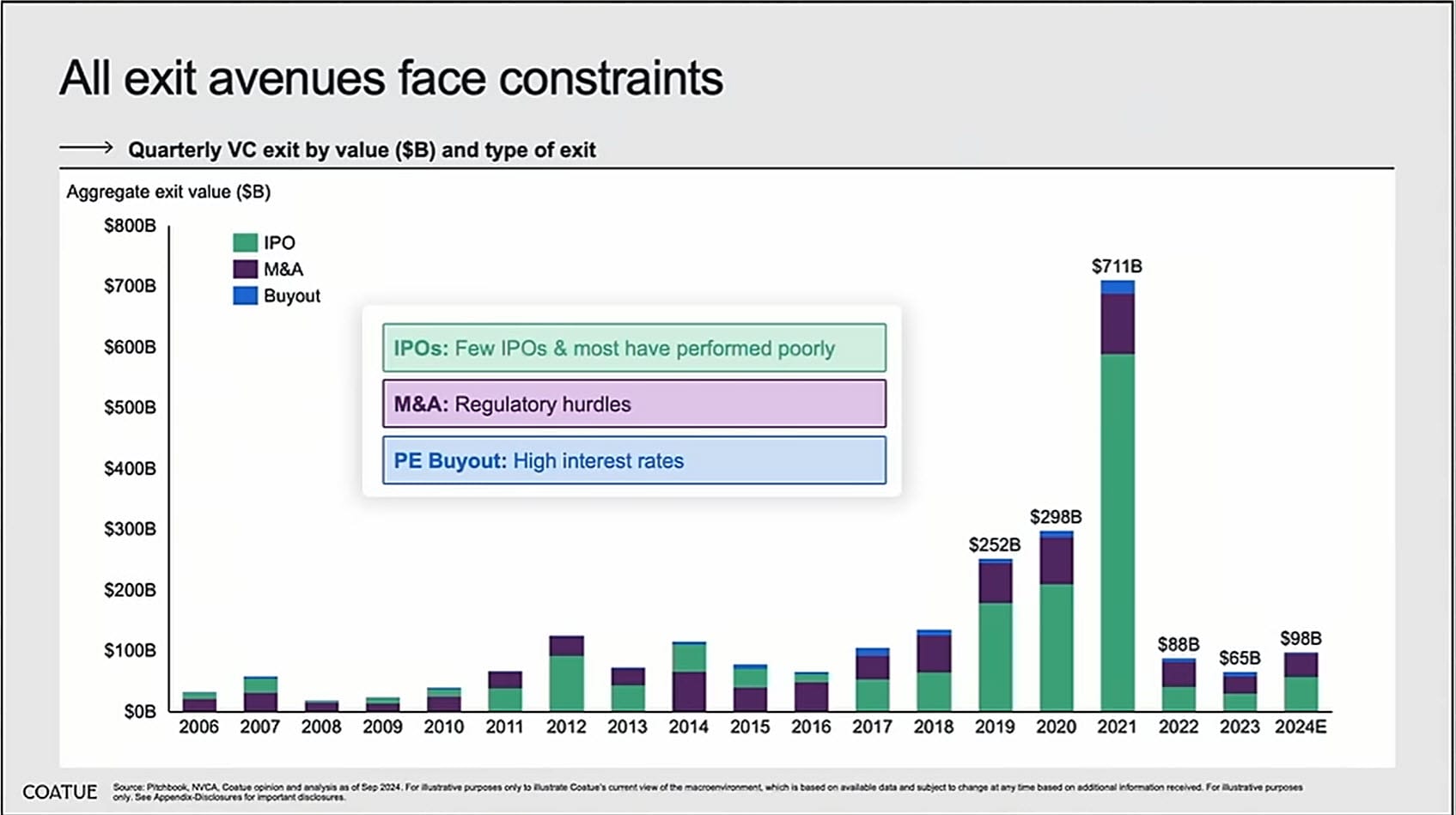

Venture capital piled into private companies at the best of times in terms of potential exits—zero percent interest, 100x prices/sales multiples, and a free-flowing M&A market.

Here is a picture of what it looks like when all the doors slam shut simultaneously. Rates increase, valuations compress, and regulatory risk casts a pall over M&A.

This results in a massive imbalance and the current "purgatory," where over 1,000 private companies valued at over $1B have no apparent path to liquidity.

The ugly truth is that many of these companies will not have any further access to capital and are facing extended paths to any level of liquidity. This is echoed in conversations with some founders who expected to exit and now face the grim reality of growing a sustainable, profitable business that can justify their most recent valuation.

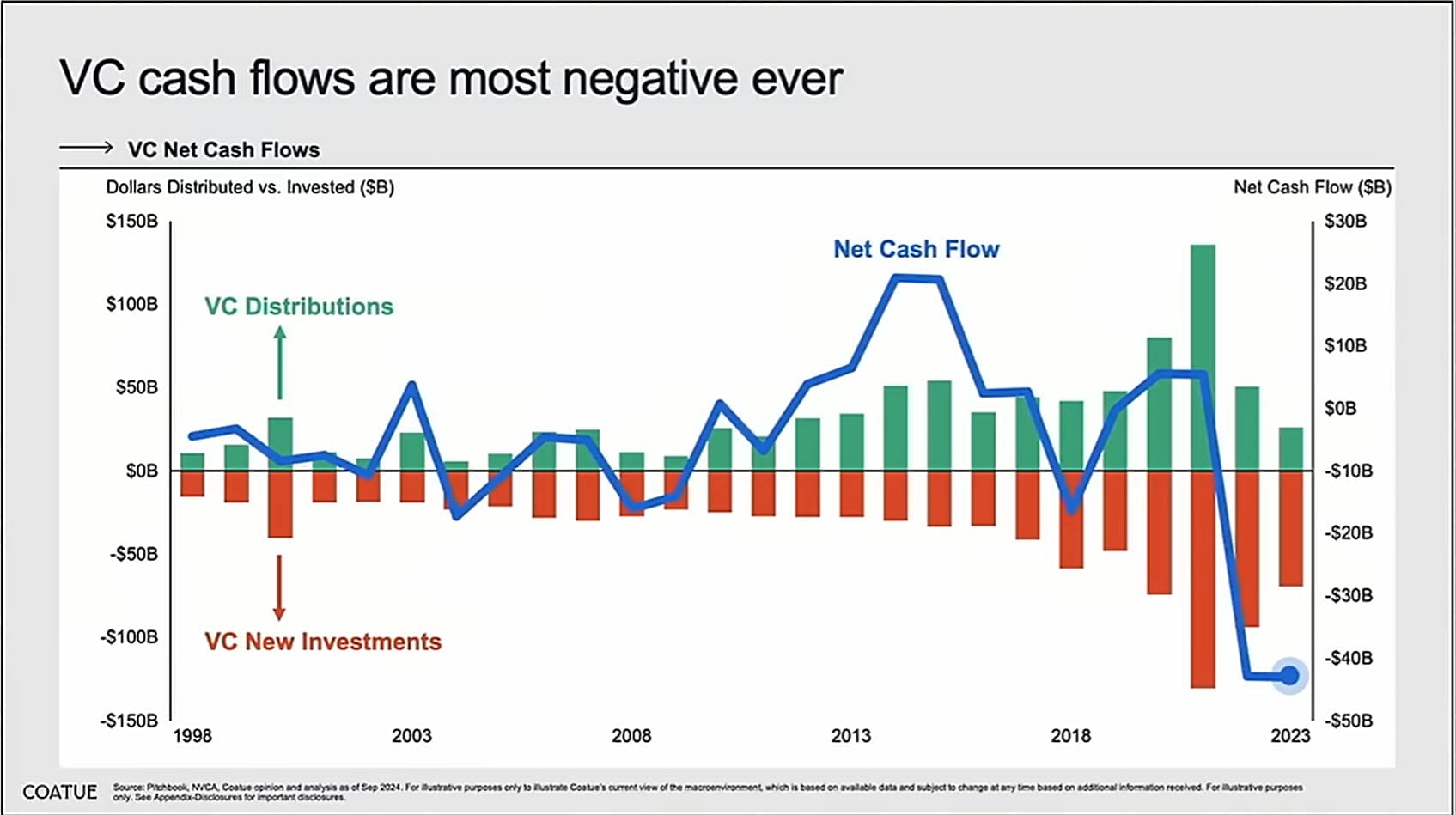

Venture and private investors find themselves in an awkward position of having sunk a lot of capital into companies without good near-term liquidity prospects. Some VC funds have taken steps to

Nobody will shed a tear for the rich's massively negative cash flows. This is material since it is a critical source of expansion capital for companies that cannot tap into public markets.

Founder and employee liquidity has been challenging as companies stay private for many more years than expected. Later-stage private rounds sometimes include limited liquidity for founders and senior company management. Larger private companies like Stripe have conducted multiple internal tender offers for employees to sell stock privately via a tender offer funded by external investors and backstopped by the company.

The conclusion is that many high-valued private companies are trapped between private markets that are low on liquidity and public markets that are not welcoming to many of them.

Investors want Work Horses, not Unicorns.

Venture Capitalists and private investors love unicorns. That's why they create so many of them. The game starts early with a round followed by several "up rounds," which drive higher "market to market value" for them.

The dynamics of private investing are very different from those of public markets. VC firms compete to "get in" on a deal. They have to deploy their capital, and their incentives are to earn their fees. Valuation is not a "thing."

Unicorns may be pretty, but public market investors must ask how far they can pull a wagon. In many cases, the answer is no. WeWork is a fun example. After raising many rounds of capital at stunning valuations, the company filed for an IPO.

As soon as we read through the prospectus, we were mystified. The company was uninvestable. Most came to this conclusion after three minutes of scanning the business section. How did anyone think this company would make it?

We have frothy public market periods when investors are more inclined to ignore fundamentals. The last one was during rampant government stimulus and zero percent interest rates. In this market, companies can expect IPO investors to want growth with expanding margins, increasing returns to scale, and a path to profitability.

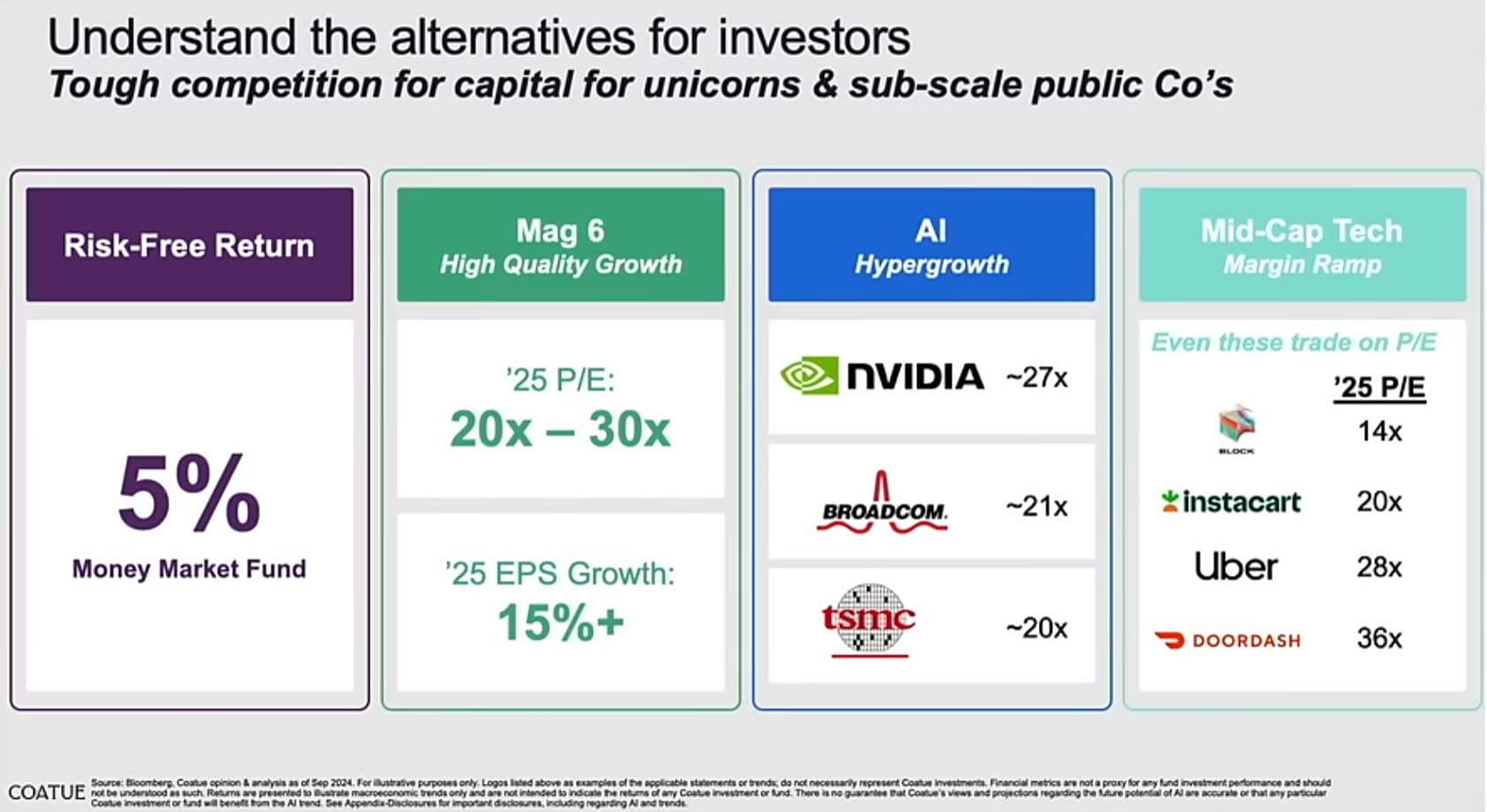

As Laffont also points out, public investors now have alternative investments that can be used as yardsticks for measuring new IPOs.

When comparing an IPO to existing public options it's harder to measure up now than two years ago. Laffont's numbers are a bit out of date now. Still, the point is that investors have rapidly growing, profitable, and reasonably valued alternatives to any new name being presented to them.

There can still be very high multiple IPO deals in the AI space. After a period of poor performance, Astera Labs $ALAB is finally performing and is now trading at a $10B valuation over 30x sales. Against this backdrop, new deals like Cerebras $CBRS may still receive a warm reception.

Even more compelling are the opportunities investors can find in less-followed companies. We have two significant AI holdings trading at 1x sales with a 10x P/E.

[A new AI IPO is coming next week, and it looks like a 300%+ price appreciation opportunity. Our paid members will get the details next week. ]

What is Jamie Dimon saying?

Jamie Dimon has much bigger fish to fry than the IPO market, but reporters often put him in a position to opine. Dimon's recent comments touch on a few dynamics of the current ecosystem.

IPO fees are as high as ever, and public company costs are higher, too. Banks compete at the high end, but mid and lower-end financing deals are expensive. We just reviewed one with fees of $7M on a $50M raise.

Public company costs vary, but for a small company, it's around $1M annually at the low end. That's not even accounting for the time and attention the CEO and CFO require to deal with public company tasks like earnings calls, investor relations duties, and attending conferences.

Dimon discusses the "lack of research on smaller companies," which has been a problem for decades and is structural. Passive investing has played a significant role. Index and ETF investing drives money into the largest, most established companies.

Passive investing has trounced active managers and now dominates the equity markets. When we do work with small companies, it's always with an eye toward whether they can at least make it into the Russell 2000 soon.

Larger IPOs like the recent KinderCare $KLC are easier to get done because they are guaranteed to be swept up into the major indexes as a public company. This forced buying gives IPO investors a warm security blanket of future share demand.

Research for smaller companies has not yet found a sustainable business model since the boutique investment banks disappeared over twenty years ago. For the banks, the cost of a "stock coverage slot" is now over $250K per year. High costs drive coverage toward only the very largest companies.

Nvidia $NVDA has 62 equity analysts covering them, Astera Labs $ALAB has 12, and smaller names we look at have between four and zero.

We'll return to research in a different context, but for now, nothing that Mr. Dimon is talking about will change.

Forward Progress: Private Markets, Auctions, and AI.

The good news is that the scale of the problem is finally attracting more attention. While I'm confident that IPO Candy will have more than enough to do in the current market, it's unclear whether the industry will reform much.

The most significant near-term relief for trapped companies and investors is for the M&A gates to reopen. That's part of why everyone wants Lina Khan out and a more passive regulatory regime to take over.

Some areas to watch:

I. Private markets: Some significant shifts are happening in private equity and private credit markets. The ability to have quasi-active markets in private credit is past the drawing board stage and close to getting regulatory approval.

Could we revisit private markets for pre-IPO markets? These have been tried before and had a spark of promise around the Facebook IPO, but they soon fizzled. We consulted and acted as a research provider for SecondMarket, which is one of the lesser failures thanks to NASDAQ, which bought the company in 2015.

At the time, nobody had a plan for handling ongoing research coverage and market making, which was part of a business model. They also didn't have the resources needed to invest in making it all work.

One difference now is that the market-making companies have done staggeringly well and have massive resources. It may be too small for the larger players like ICE or TradeWeb $TW to have an interest. A smaller company like Robinhood $HOOD could pull something off. Perhaps the biggest obstacle is difficulty relative to expected profits.

II. No Reserve! Offering, pricing, and allocating an IPO via an open online auction is not technically challenging. Although it feels "risky," established companies like Morningstar $MORN and Google $GOOG have proven it works.

In theory, the IPO process is about price discovery, but the banks still pick the filing range and ultimate pricing. Nobody wants to file and price a deal at a valuation below the last private round, so they put it off. If they try and fail, they cite "unfavorable market conditions" rather than "we are not a good enough investment at this price."

III. AI? If it costs $5M in fees to get a minor deal done and millions more to provide active coverage and compliance, maybe there is a way to do something "cheap and cheerful" to meet basic requirements.

In the case of a "secondary market," AI could be used to handle reported numbers, valuation ranges, and trading levels. It's even possible now to generate qualitative insights on changes in business conditions and benchmarks relative to comparable companies and identify hard-to-see favorable and unfavorable trends. (Think about changes in AR vs. revenue growth, deferred revenue growth, and backlog levels.)

Over the years, I've put together pro-forma companies that could replicate something like the boutiques of old, but they all come out unworkable—primarily due to high personnel costs. Maybe we are finally at a point where it could work.

Our Conclusion

Keep your eyes wide open and your head on a swivel. We're not done!

Here is a PDF of the slide deck; they are not in the original order but in the order I prefer them. You can watch YouTube for the entire treatment.