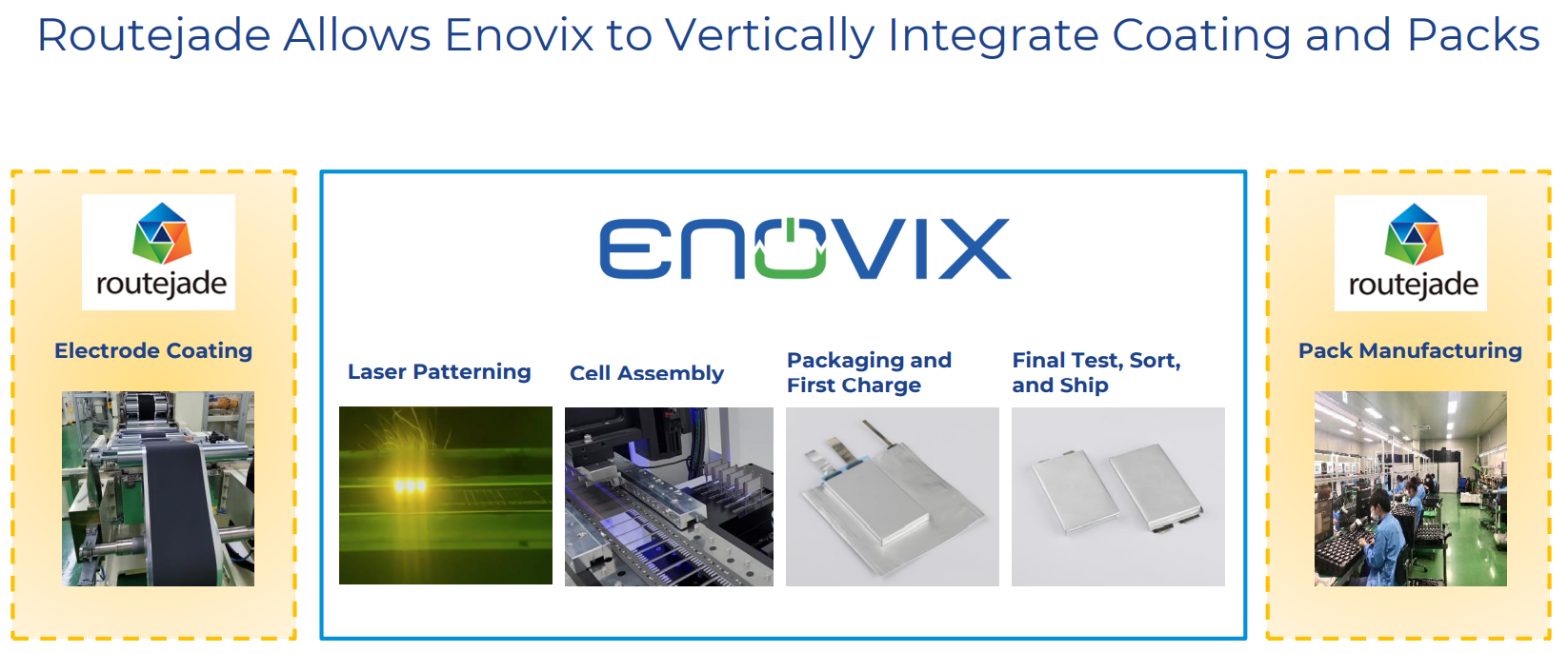

The transition from a pure "story" stock to one driven by fundamentals can be hard as new investors finally get numbers they can use for valuation. Enovix $ENVX has recently announced a significant acquisition which accelerates their path to commercialization.

I've not been tempted by all the "emerging battery plays" including Enovix, QuantumScape $QS, Amprius $AMPX, FREYR $FREY, SES.AI $SES, and Microvast $MVST to name a few. The reason is simple:

Batteries are a scale business. Innovation makes a big difference, especially in terms of process but invention is the easy part.

The massive players in the Lithium battery market also have huge R&D budgets and a focus on innovation. It's not like they are just big dumb factory owners.

Battery technology has long been interesting but most of the "exciting" companies have gone out of business. Does anyone remember A123 out of MIT?

It's a market worth following but hold on to your wallet until you see the green of their ROIC!