CuriosityStream $CURI is a broken SPAC IPO. This is a streaming company focusing on documentary content. The heritage is based on The Discovery Channel. It's a classic case of early enthusiasm for a "massive opportunity," accompanied by significant spending and substantial losses.

The spending funded a content asset, which is now being monetized through conventional subscriptions, most recently for training AI models to handle video content. The value of the content library, along with $39M in cash, makes up the majority of the current $200M market cap.

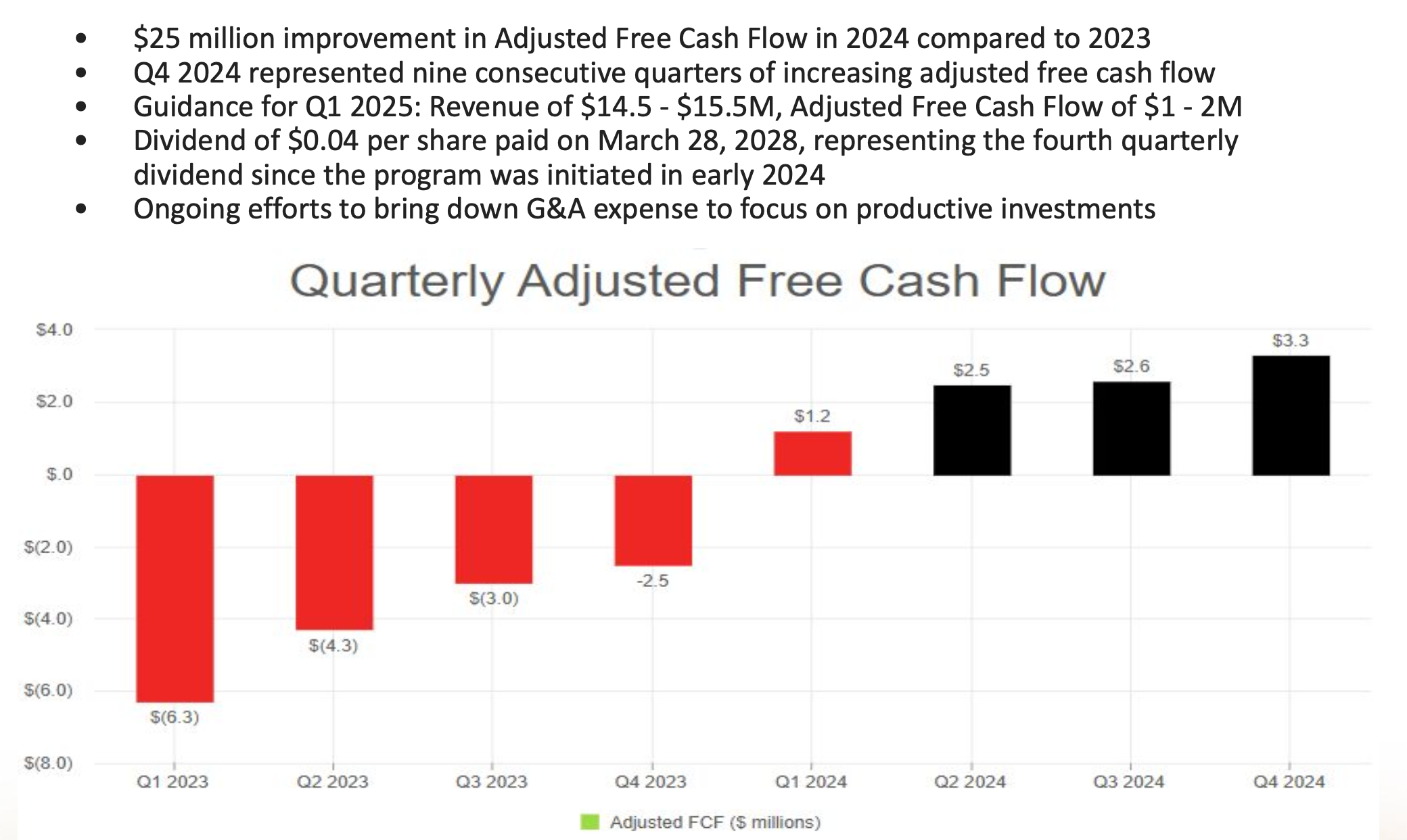

The company has cut expenses to achieve a positive cash flow, despite minimal growth, and is now poised for substantive growth following content licensing deals.

With better growth this year, the P&L will continue to improve, supporting higher stock prices and potentially a re-rating.

Included below are sections on AI Growth Drivers, Bonus Factors, Stock Conclusion & Valuation, FAQ and disclosures.