Arlo Investment Case Summary

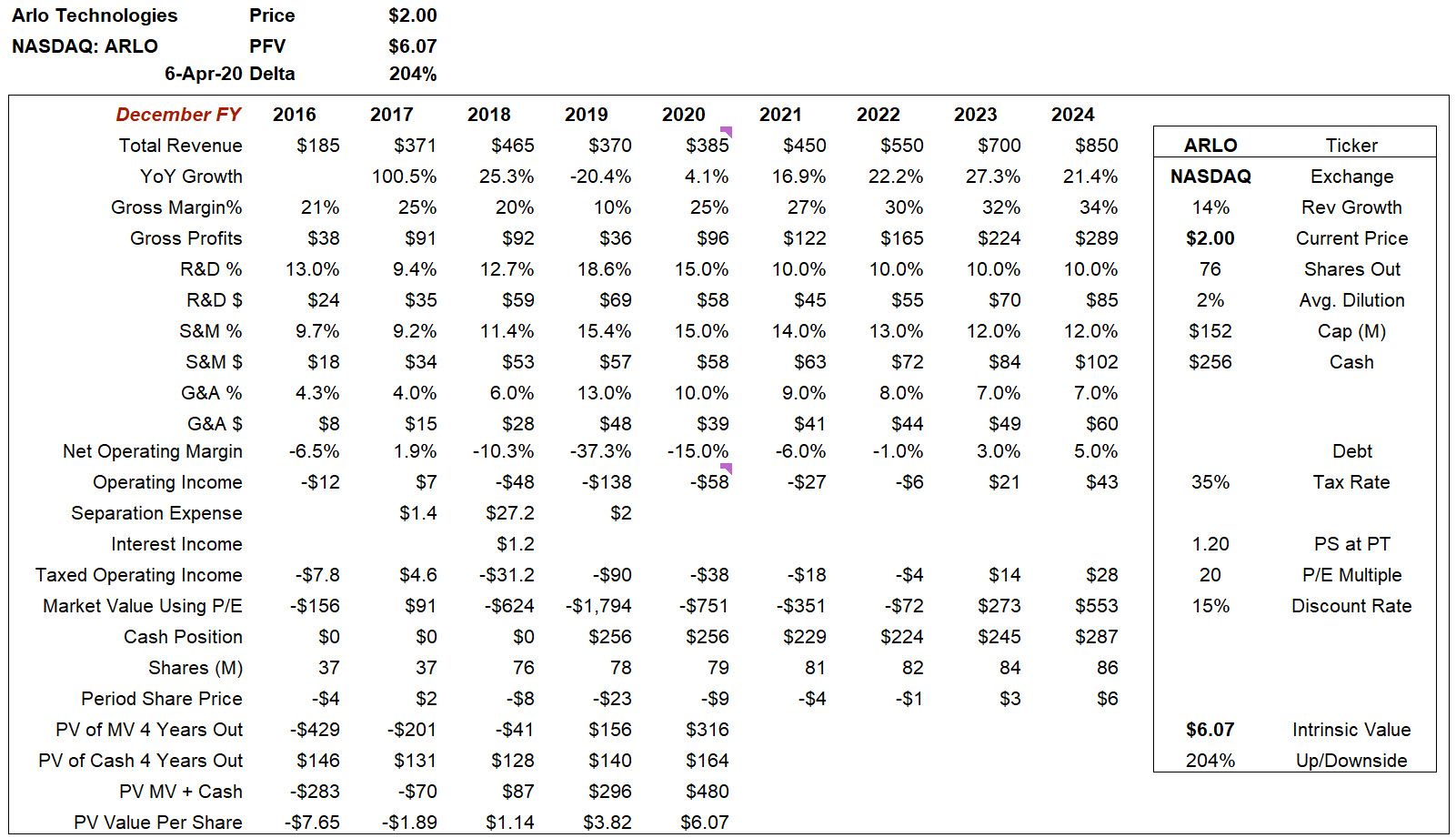

Arlo Technology (ARLO) is a maker of connected cameras and related software that was spun out of NETGEAR (NTGR) with an IPO on August 2, 2018 at $16/share. Shares traded higher immediately following the IPO and reached $23 before starting their steady decline to the current $2.15.

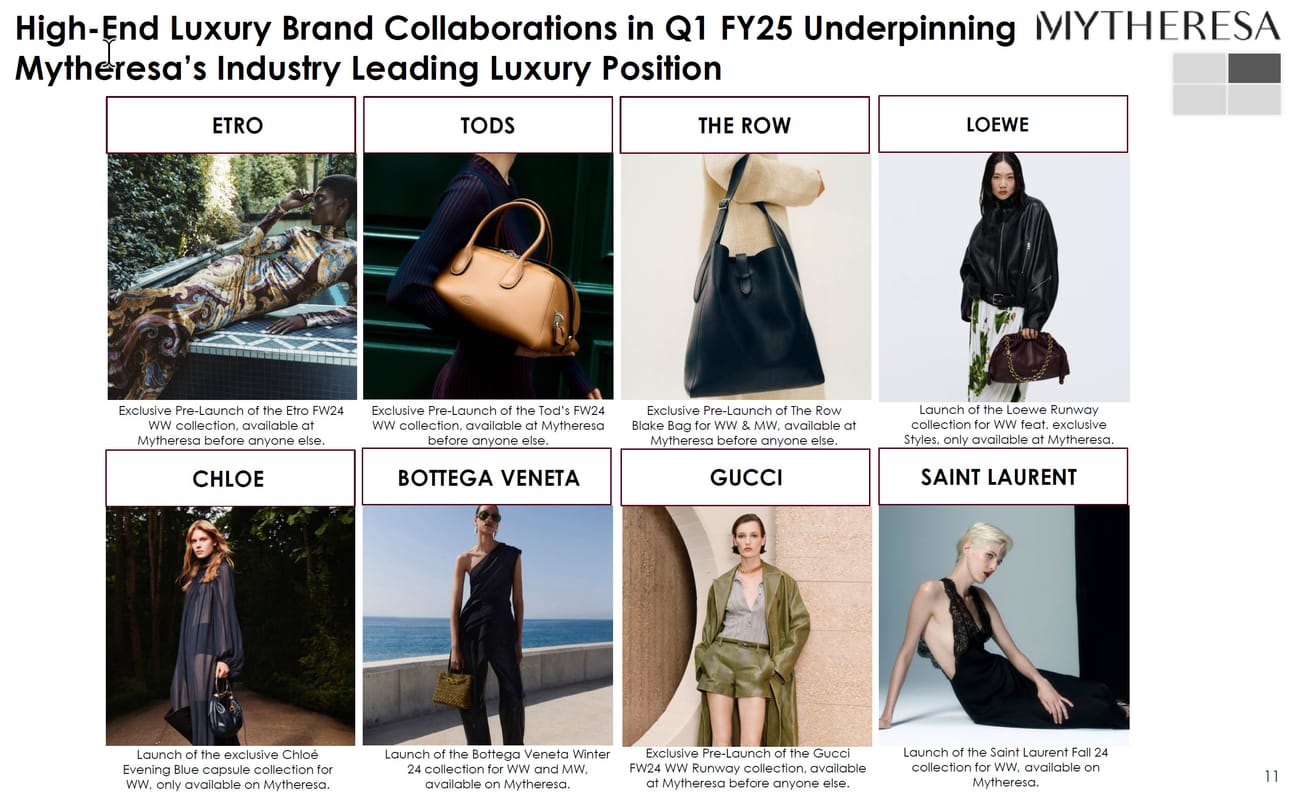

There are two main reasons for the massive reset. The first is that their product revenue declined in 2019 to return to 2017 levels. The second is that their "attach rate" for paying subscriptions was very low. It also didn't help that NETGEAR distributed their 62.5 million shares of Arlo stock to their shareholders effective December 31, 2018. The chart conveys just how broken this has become.

Investors don't like hardware businesses because they are variable and carry low gross margins. But the software business, particularly the SaaS model, is a different story. There are a few key developments at Arlo that suggest the company is already turning around their fortunes.

- In the 2019 the company started bundling a free trial of their Arlo "Smart" subscription with their product and made the pricing and features much simpler. As these trials expire we are likely to see a material increase in the attach rate and SaaS revenue.

- Arlo did a deal with a large security firm based in Europe to take over all their distribution in Europe. The deal included a $50M payment and purchase commitments that could add up to $500M over the five year deal. The first minimum ($20M) was already paid for 2020 and the next one is $40M for 2021.

- New products like the video doorbell and others will contribute to growth in 2020. Hardware has consistently been a strong point for Arlo and they have made substantial upgrades to their software to remain the #1 or #2 vendor in their category.

- Easier comparisons to results last year and conservative estimates set the stage for better reported growth and increasing estimates.

Valuation is compelling at these levels. The current market value of $140M compares to revenues of $370M and cash on the balance sheet of $257M. Right now the company has a negative enterprise value of $100M. Setting the value of the business to zero would already result in a stock price of $3.42. Our model suggests that the shares are worth at least $6. At the price the valuation would be just 1.2x sales.

We would love to see the company take some actions to lower expense levels further and accelerate their timeframe to profitability. This is a space where large players abound and wonder if Arlo should also be looking at "strategic" options with some of them.

Improving Business Mix

Arlo first distinguished themselves with better hardware. Their cameras and other devices have been consistently better than other products. They have bested large companies including Google (Nest) and Amazon (Ring) with their offerings. Their products have also stood out among the many small vendors that serve this fragmented market. This hardware advantage has faded somewhat as other products have been improved and are now very competitive.

Arlo still holds their own versus competition. The latest rankings have 3 or 4 Arlo models in the top 10 versus 1 or maybe 2 for other vendors.

Where Arlo struggled was software. Their basic offering is free and works well enough but isn't especially good. At the beginning their paid subscription plans were expensive and very few customers opted for a paid plan.

For 4Q 2018 the company reported 144K paid accounts out of a total of 2.85M registered accounts. By the end of 2019 the paid accounts increased to 230K out of 4M registered. That's only a 1% improvement but growth in paid accounts is consistently higher than growth in total registrations.

The attach rate is improving in part because they have made improvements in the software in terms of performance, functions and ease-of-use. Now the quality of their software is consistent with the hardware and provides a more durable competitive advantage.

Arlo also went back to the drawing board on pricing and launched much more attractive options for consumers that scale up to small businesses and "power users" that have multiple cameras. Today plans start at $2.99/month for a single camera on 2K resolution and $4.99/month for 4K resolution. At the upper end they offer a $9.99/month and $14.99/month plan for up to five 2K or 4K cameras respectively. Customers can have more and they get added on at 50% of the single camera rate.

In short they have an appropriate "starter plan" that scales up gracefully so they can grow average revenue per customer over time.

There may also be some enhancement to the conversion rate due to "built in" trials that come with new products. This is just marketing 101. Instead of limiting new customers to the free plan and asking them to upgrade they get the premium plan for free and then will face a decision to either start paying or lose the features they may be enjoying or relying upon.

Investors should be focused on this attach rate and services revenue number. If Arlo continues to deliver significant improvements in the attach rate and accelerating growth in services revenue their shares will certainly trade at a multiple of their current cash value rather than the current discount.

The Deal for Europe with Verisure

At the end of 2019 Arlo completed a deal that essentially outsourced their European operations to Verisure, a large security company based in Geneva and active across Europe and Latin America with ~3M customers. Verisure dates back to 1988 when it was Securitas Direct. This became an independent business with 1M customers in 2006 and was relaunched under the Verisure brand in 2009.

In the deal Verisure paid Arlo $50M for their existing European operations and committed to purchase up to $500M of Arlo products over the next 5 years with minimum purchase amounts for each year. Arlo expects "one-to-one" attach rate of these devices with the Arlo SmartCloud.

The Arlo SmartCloud is their new B2B offering of what consumers know as Arlo Smart. This positions Arlo as a PaaS vendor if they can convince other security companies to use their software in delivering their branded solutions. Verisure is the first customer for this and we'll see if others follow.

The deal with Verisure looks good for shareholders even if some details are still unclear. The timing of orders is one. Verisure did pay $20M in Q4 for products they expect to order in 2020. We also know that the second minimum (for 2021) is $40M.

Margins on resold products and services are also unclear at this time. During the next two or three quarters we will have much better visibility on how the moving parts will work on this Verisure deal.

Products

Even though the story of the stock from here will be about software and services, products still matter. They are after all still 90% of revenue.

Recently Arlo has launched a range of new products including a new version (3.0) of their core product line and some notable additions including the Arlo Doorbell, and the Arlo Pro 3 Floodlight.

The core product line is a family of connected cameras that are tweaked for specific use cases like:

- Outdoor - these are weatherproof and designed for mounting outside, typically with a rechargeable batter. Older products like the Arlo Pro and Arlo Pro 2 are being phased out in favor of the newer Arlo Pro 3 (2K) and Arlo Ultra (4K).

- Indoor - these are smaller and cheaper. Arlo offers the Q and the Q Plus. The latter has a power over ethernet option. These are basic but get good reviews and are the simplest to install and use.

- Mobile - the Arlo Go works over any LTE network so can be placed without WiFi network constraints. It's also weatherproof for outdoor use.

Arlo has introduced more specialized products for "front door" applications including the Arlo doorbell and their floodlight camera.

- Video Doorbell - This is similar to the Ring product that Amazon (AMZN) purchased in 2018 for $1B. In most reviews the Arlo product beats the Ring offering. Ring has also experienced some negative press regarding user privacy and the potential unwarranted use by law enforcement.

- Floodlight Camera - The Arlo Pro Floodlight is not yet shipping but it received excellent reviews at CES. The product is scheduled to ship in "Spring 2020" and unless supply chain issues become a problem revenue should begin in Q2.

Arlo also sells a range of accessories including mounts, cables, chargers, solar panels and skins to match phones to their environment.

Management has hinted at new products for Q2 but it's not clear that any new products are needed based on the breadth and depth of the current lineup. If they delay these launches to Q3 of 2020 it might be a good thing.

There are myriad competitors in the market and often lower prices are common. However this is a product where quality and reliability matter. And so does the software. We've read many reviews of other products that seem equivalent in terms of features with much lower prices but customers complain of quality issues, poor software and limited support.

Many users of Arlo outdoor cameras have posted reviews about them being outside for years and continuing to work flawlessly, even at very low temperatures and harsh conditions. Being undercut by off-brands will impact their business but they do have a clear quality advantage over these other products.

Management

The management team is made up of ex-NETGEAR managers (SVP HR, SVP Finance, SVP Sales, and CFO) and an odd concentration of ex-VIZIO executives including the CEO, SVP Technology and SVP Design.

The background of the senior management team goes some way to explaining the relative strength of their hardware out of the gate. The software clearly took a back seat in terms of quality. As noted above the company has been catching up and the software is no longer detracting from the overall solution.

They also seemed to take quite a bit of time to make some moves like bundling the trial and implement their own direct-to-consumer (DTC) channel. These are the kind of things a real start-up would have led with but instead Arlo played catch up. That said they have caught up.

The reviews at Glassdoor make for good reading. There probably isn't enough data to draw any firm conclusions but one thing is sure. If a company has a stock that declines from $23 to $2 then you can be sure their employees are not going to have good things to say about management.

In general our assessment of management and the board of directors is cautiously optimistic. This is mainly because what they need to do from here is fairly well defined in terms of executing on the strategy they put in place in 2019. There are certainly disruptions to deal with in terms of the pandemic that will impact the company. They, like many including Apple, may hold off on some product introductions until later in 2020.

Over time it might be a good idea to bring in some new senior managers and board members from other companies to diversify and strengthen the governance and culture there.

Valuation

Our Present Future Value (PFV) model is below. Because the shares are currently so depressed the assumptions are conservative. In terms of cash alone the company has a negative enterprise value of $100M and the company is worth more than nothing. Setting the EV to zero would get the share price to $3.42.

Catalysts

This one probably falls into the "valuation discrepancy too big to ignore" but with the company still losing money it's worth noting the following:

- Products with the build-in trial are coming off trial now and will provide the first opportunity for the company to show improved results from this new model. That is likely to come with the March quarterly report when they provide it.

- The company plans to do more deals with other companies to use the Arlo Smart Cloud technology with their own devices. It's doubtful they would do that with a direct competitor here in North America but we could see it in other geographies like Latin America or Asia. That could dramatically accelerate SaaS revenue and shift the mix of business further away from hardware.

- Two insiders, the CEO and the Chairman, bought stock late in 2019 and might do so again at these levels when the window is open. Insider buying can signal to other investors that the fundamentals are better than the stock price.

The Bear Case and Real Risks

The company has grown but in a lumpy fashion. As they have gotten bigger margins have not improved. Competition is intense. The company is losing money and plans to continue losing money for the next year. It's not unreasonable to "wait until the smoke clears" and SaaS revenues accelerate and lead to improving margins.

The company has already disclosed that the virus has had a material negative impact on their business due to their inability to source components from China as their factories have had limited capacity. This is especially impacting their ability to launch new products which may now be delayed from Q2 to Q3.

The deal with Verisure is a landmark but it carries with it some questions and some risks. First of all the price was about 1x sales which is quite modest. We have very little visibility on how Verisure is executing and what the timing will be of their expanded business with Arlo. What if they don't execute?