Karman Space & Defense $KRMN is coming public as a key player in the production of missiles, which seem to be going off regularly in the Middle East.

Karman has carved a niche in the aerospace and defense industry by focusing on high-temperature composites and advanced materials. The company provides critical components such as nose cones, heat shields, rocket motor nozzles, and motor cases, serving sectors including hypersonics, missile defense, and space launch systems. Karman got here by rolling up seven smaller companies in the space.

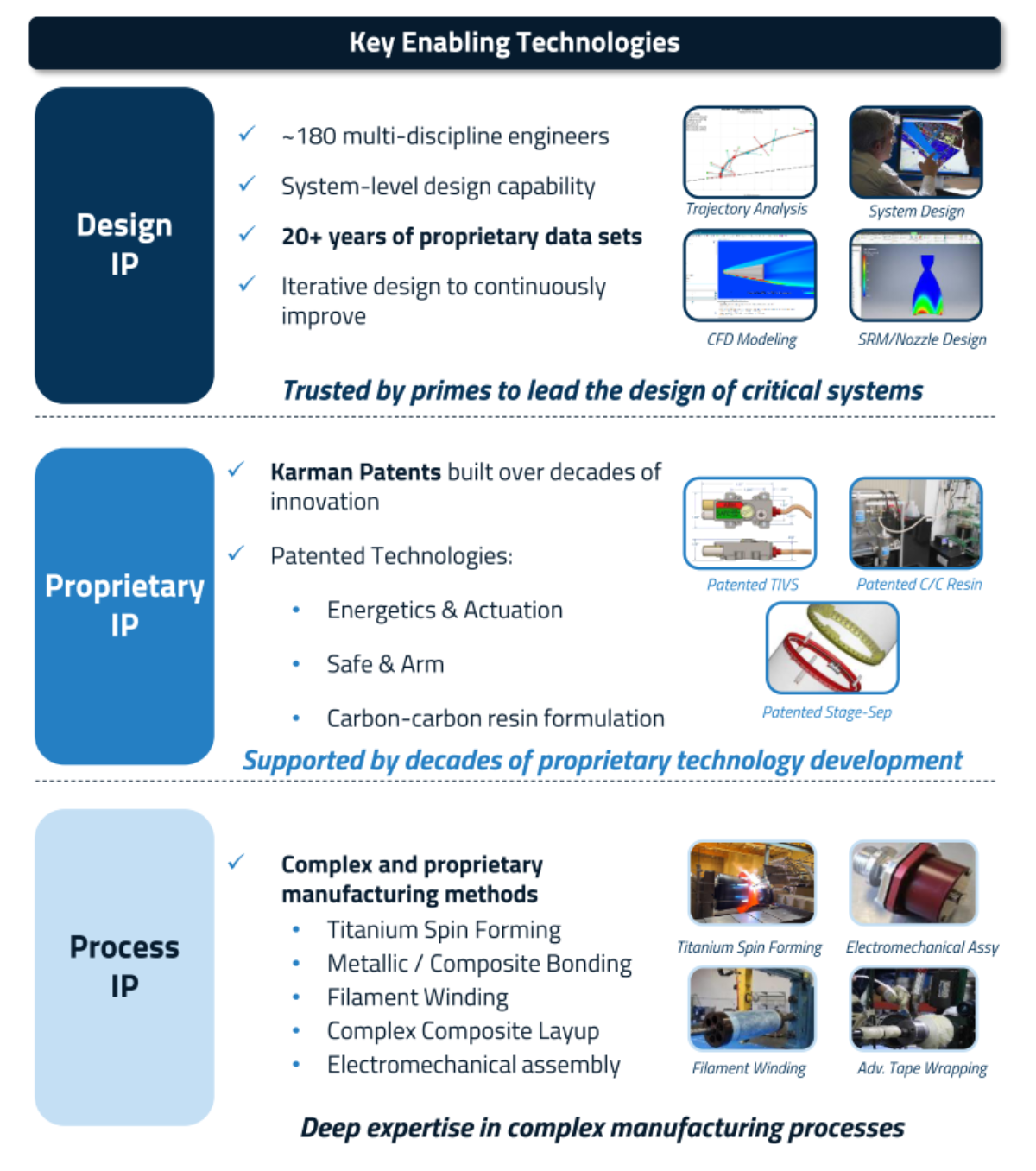

The "special sauce" that Karman has is around high-temperature composite structures that are critical for hypersonic vehicles, missile defense systems, and space launch platforms. These components require extreme precision and must withstand harsh environments, making them highly specialized and difficult to produce at scale.

These materials demand tight control from vertical integration and tight supply chain control. Variations must be kept to a minimum and production times are critical.

Karman has also effectively built an IP and trade secret moat around producing key components used in high-value military and defense end products.

The company's growth strategy is to leverage these fundamental building blocks into more subsystem and system-related contracts.

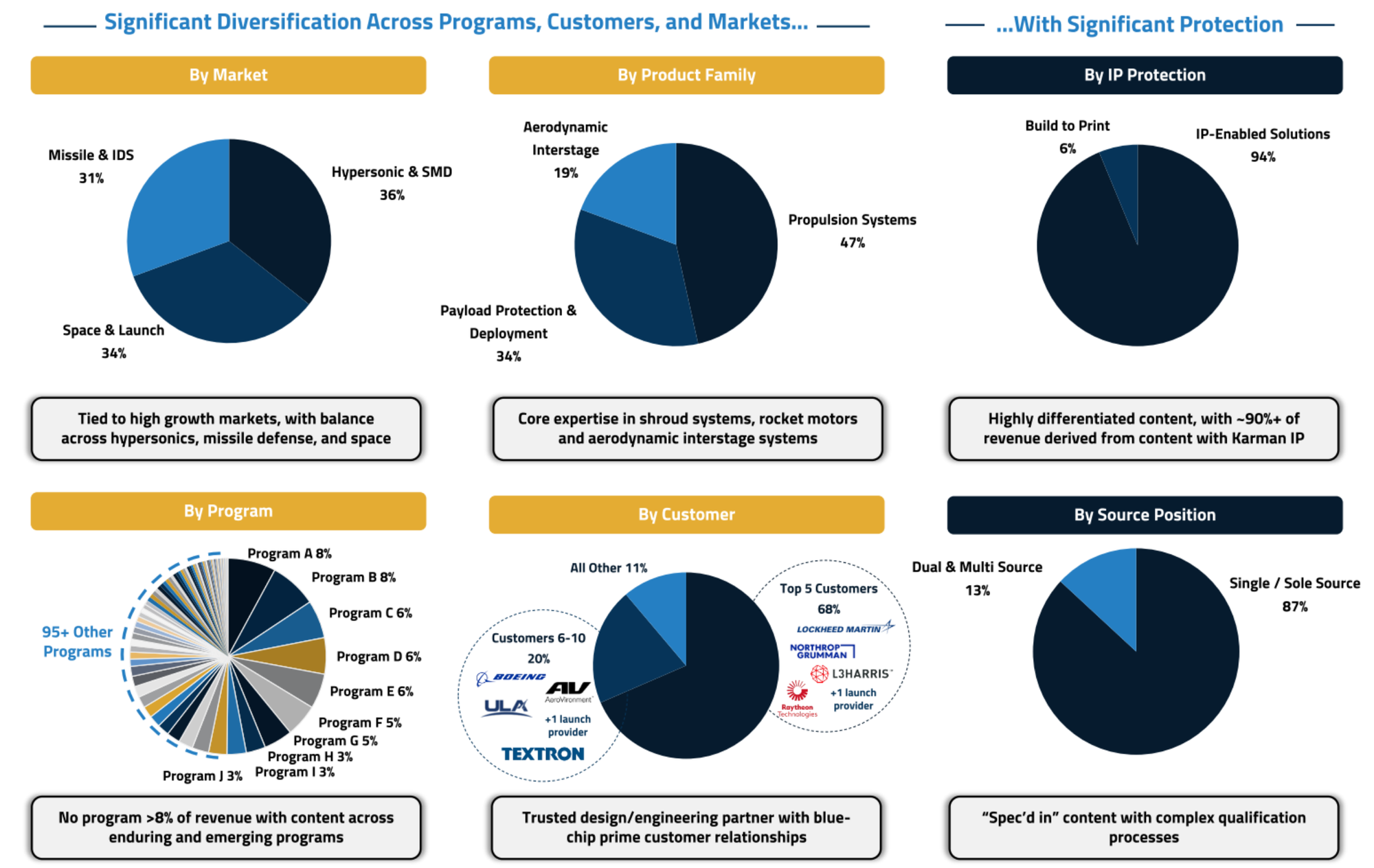

Customer Concentration

Karman is a sub-contractor to most of the primes in the military defense complex - Lockheed, L3Harris, Raytheon, and Northrup Grumman make up more than half of the total revenue. If you include smaller customers like Boeing, AeroVironment, and Textron, the top ten customers represent close to 90% of revenue.

This position is a bit of a double-edged sword. The large prime contractors are experts at keeping the most profitable parts of large programs and then farming out the lower-margin, less desirable parts.

Some new pressures are also emerging from the government's "DOGE" effort that will eventually turn to military and defense contracting. Firms like Anduril have been busy building a "new model" of procurement that they are using to gain market share over the established mega-vendors.