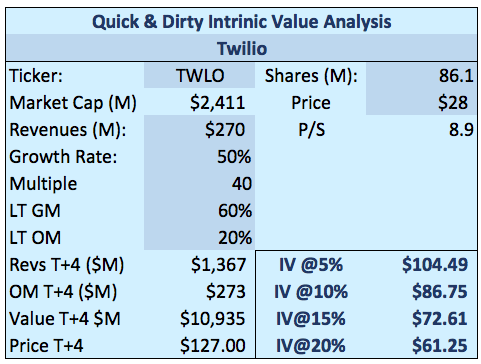

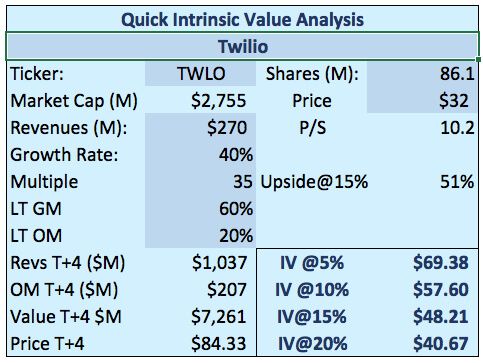

[UPDATE: May 4, 2017] Twilio is losing a chunk of business from Uber, their largest single customer. It's a blow and it will impact the next few quarters. The shares took a big hit which is to be expected. At this point, however, the investment thesis remains intact, and the company continues to add new customers and grow existing ones rapidly. We'll have more to say on it but we do think that we should revise our IV model to factor in the potentially slower growth and a lower multiple. This takes the IV target down materially but it remains attractive at $48/share.

I've seen this happen before in the space. In one case it turned out to result in the largest investment gain in my investing career of over 30 years. The circumstances were different, but it was a software infrastructure company called BEA Systems. The stock was at $24 or so and on a tear. They reported a strong quarter and beat estimates but unknown to all at the time saw a dip in their close rates on new business. They didn't know if it would persist, so they lowered guidance. People were shocked and cut the value in half. I was an analyst covering it then and had to downgrade it to let the dust settle. A few months later, I was the first to upgrade it as every part of the story checked out as continuing to work, and I expected close rates to go right back up. That's what they did, and the shares went from the teens to the $40's fairly quickly. They did continue to be over $80, but that was a product of the 1999/2000 bubble.

The big challenge I see for Twilio management is how they handle this situation with investors. If this really is a blip and they can be honest about it then it will go a long way to keeping investors confident in the company, the opportunity, and the management team. If they attempt to gloss over things, they will set themselves up for a potential catastrophe of confidence which will impact not only the stock but also how customers see the company.

Given the current prices and revised business outlook, the shares are equally if not more attractive than when we published the note below in January with the stock trading at $28. Sure it would have been nice to sell some at $34 and be buying them back now, but we're looking at the long-term opportunity here.

Our original Twilio analysis from January 2017 follows:

One of the ways we scoop up long-term winners is to wait until after the IPO hype subsides, and the six-month lockup agreements expire. The extra supply creates selling pressure when there isn't much new incremental demand. For companies with very strong fundamental stories, these times create opportunities for long-term investors. We've seen this movie before. Our target on this one is $72. Their next earnings report is scheduled for February 7th, 2016.

[UPDATE: Since we started writing this, Oracle (ORCL) bought Apiary. This comes after Google bought Apigee (APIC) late last year for $625M. There have also been rumblings that Mulesoft is considering an IPO, but we wouldn't be surprised to see them acquired instead. This API space is strategic in terms of new software infrastructure. And today, we get Cisco stealing the AppDynamics IPO on the day of pricing! Read on for more...]

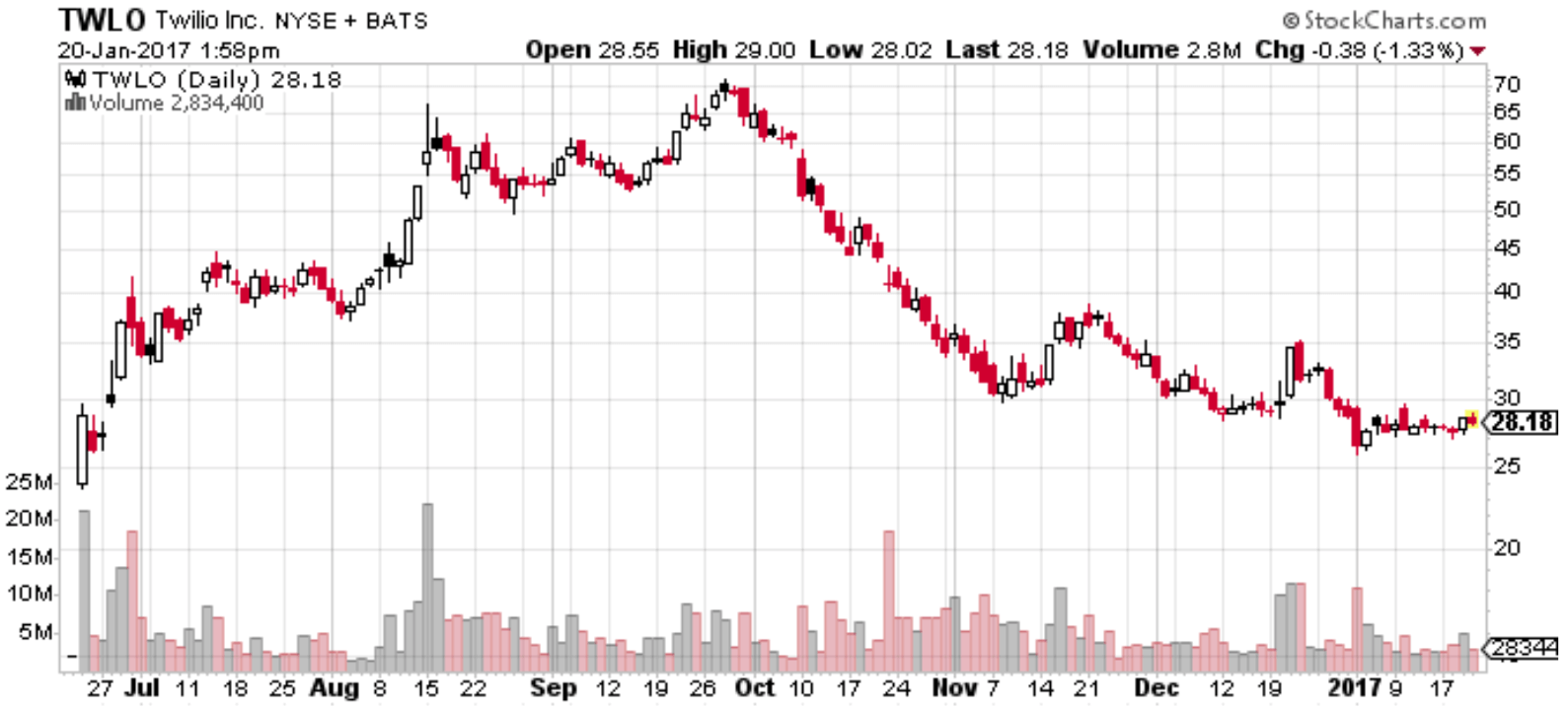

Twilio (NYSE: TWLO) came public in June 2016, and the shares soared over the next three months to touch $70. Three months later, the stock is back in the $20's. The decline can be blamed on the usual suspects - the half-life of IPO hype and the expiration of share lockups which adds supply to the market. A big chunk of shares came off lockup on December 20th, then a small one in early January. Finally, the last large chunk will come in February. (Because the company did a secondary, the pending lockup expiration is staggered.)

With the February lock-up expiration still to come, the stock will likely be range-bound until that extra supply gets absorbed. Then the shares should be able to make steady gains again.

Last week the head of AI at Baidu (NASDAQ: BIDU) proclaimed that "AI is the new electricity!" There is certainly plenty of hype around AI these days. Still, the truth is that we have finally reached a tipping point where the amount of online data combined with increased processing power can finally accomplish something.

If this metaphor for AI is true, then investors can consider TWLO the wires that connect sources of electricity to endpoints that do work. We think of Twilio more like plumbing and pipes, but the infrastructure idea is important. Every connected application must communicate and work in concert with other connected applications. Twilio is a resource for developers that need to embed capabilities like messaging, calling, and other communication services directly into their application.

The developer aspect is an important distinction because there are many online services like Zapier, IFTTT, Build.io Flow, etc. These services are set up to share data and coordinate operations between existing applications. So, for example, if you want to send an email when a new item is added to a dropbox folder or adjust your smart thermostat when your location is close to home. In terms of the "stack," these types of applications would still be built upon the basic infrastructure that Twilio provides.

What about competition?

Competitors for TWLO fall into two categories - the big companies in this space are Amazon and Google, with Microsoft making some inroads. These three all offer hosted infrastructure, with Amazon being the furthest along with AWS. Historically, AWS has focused heavily on computing and storage resources and provided basic messaging tools. At the recent AWS re:Invent conference, several announcements show where Amazon is going. There wasn't much offered in terms of additional API capabilities. New features were offered that helped developers with API development and exploitation *within AWS applications* versus between those applications and other systems.

Some low-cost options like Plivo, Nexmo, and Sinch compete with Twilio on price rather than quality, functionality, and support. Analysts who follow the space conclude that if you don't have funding, one of the low-cost options might make sense but if you can spend the money, then Twilio is the way to go. The low-end players are probably not a threat with that landscape and limited funding.

Twilio has a few advantages which provide at least a modest "moat" around the business:

The first is that they are integrated into existing applications. It's not impossible to switch out Twilio for something else. Still, it's not easy or very high on anyone's priority list as long as the company provides support. And because developers (over 1M so far) are familiar with the Twilio API suite, they are apt to continue using it for new applications too.

- They have built their own network of server infrastructure across the globe. This offers improved reliability and performance for their customer base. For many applications, slow delivery, lost messages, garbled or dropped voice calls, or patchy video are unacceptable. This is similar to what Akamai (AKAM) did in their early days by building their own network of servers in the cloud to deliver content reliably.

- Visible leadership in the category *plus* a substantial amount of cash (~$300M), makes it difficult for competitors to gain enough traction to hurt Twilio. It's a large enough lead to deter most companies from even investing in building a competitive solution. The large companies in the space have the money to spend, but they want to improve the capability *on their own platform* versus across platforms. The nature of communication as a category a major part of the value is in the breadth of coverage and the near-ubiquity of coverage.

We've looked at this one long and hard and have not been able to come up with a credible competitive threat. We are watching how the new Twilio video platform features play out. Its success (or lack thereof) might impact long-term growth, but it's too soon to tell how this will play out.

Valuation and Price Target

We've updated our "Quick IV model" to account for additional shares and higher current revenue and put a 40x earnings multiple on it. That gives us a $72 target. Investors are encouraged to read the original TWLO prospectus, view the Twilio IPO slide deck, and read our full transcript of the IPO roadshow.